40 zero coupon bond face value

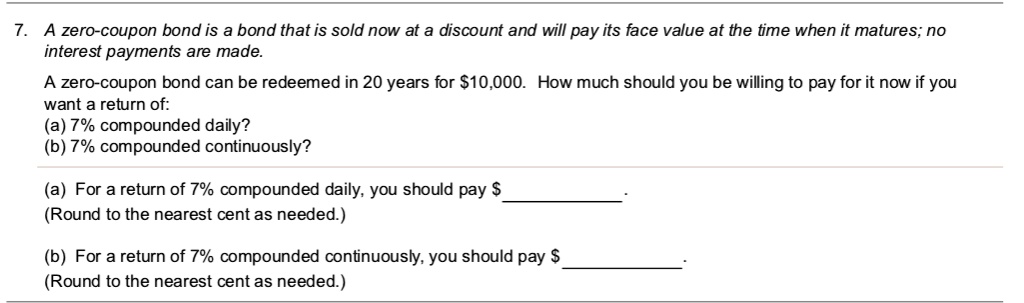

What Is a Zero-Coupon Bond? - Investopedia May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ... Zero Coupon Bond Value - Formula (with Calculator) - finance formulas After 5 years, the bond could then be redeemed for the $100 face value. Example of Zero Coupon Bond Formula with Rate Changes. A 6 year bond was originally issued one year ago with a face value of $100 and a rate of 6%. As the prior example shows, the value at the 6% rate with 5 years remaining would be $74.73.

Bond (finance) - Wikipedia The bond's market price is usually expressed as a percentage of nominal value: 100% of face value, "at par", corresponds to a price of 100; prices can be above par (bond is priced at greater than 100), which is called trading at a premium, or below par (bond is priced at less than 100), which is called trading at a discount.

Zero coupon bond face value

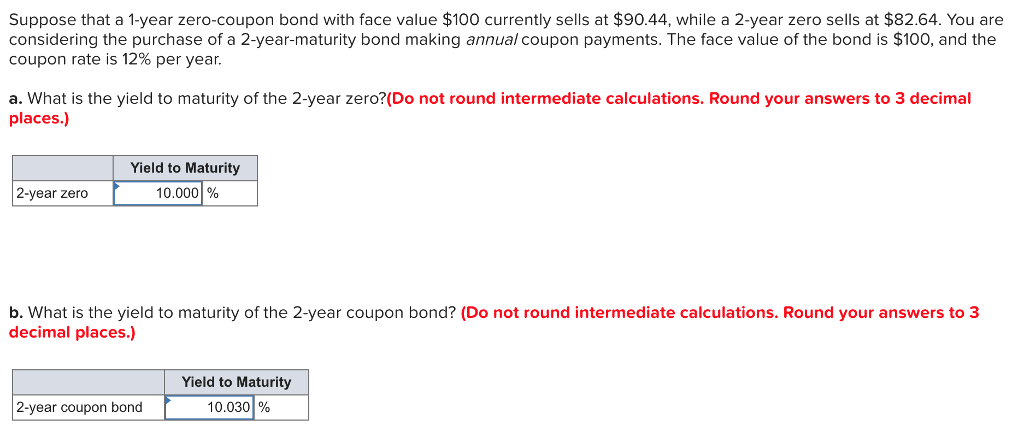

Understanding Bond Prices and Yields - Investopedia Jun 28, 2007 · If you buy a bond at issuance, the bond price is the face value of the bond, and the yield will match the coupon rate of the bond. ... How to Calculate Yield to Maturity of a Zero-Coupon Bond ... Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Jan 31, 2022 · Well, for one thing, zero-coupon bonds are bought for a fraction of face value. For example, a $20,000 bond can be purchased for far less than half of that amount. What does it mean if a bond has a zero coupon rate? - Investopedia Aug 30, 2022 · A bond's coupon rate is the percentage of its face value payable as interest each year. A bond with a coupon rate of zero, therefore, is one that pays no interest. However, this does not mean the ...

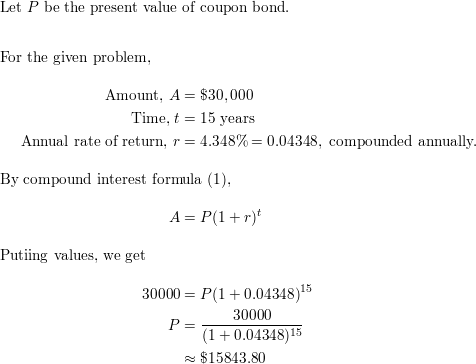

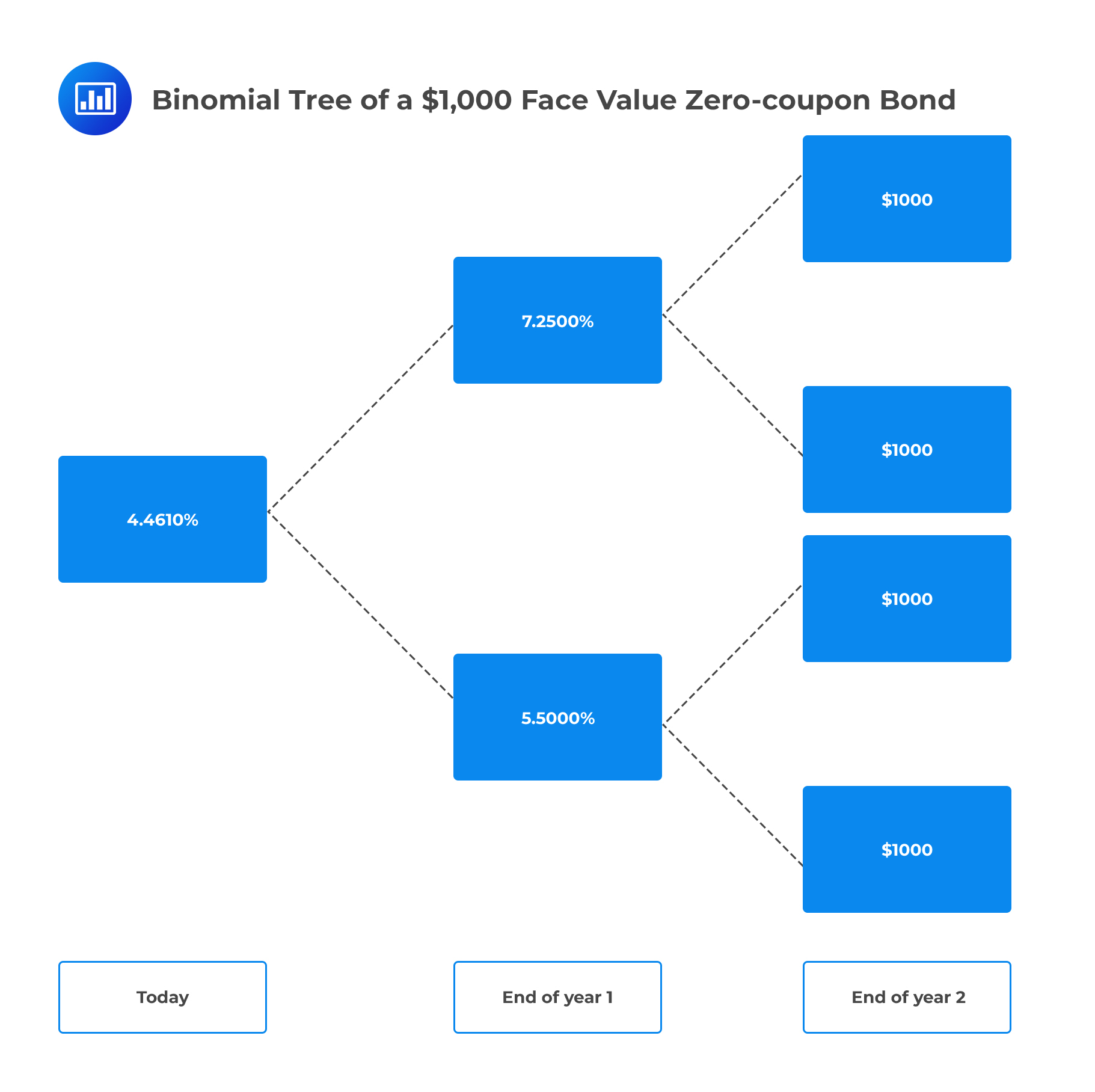

Zero coupon bond face value. Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero-coupon bond.When the bond reaches maturity, its investor receives its par (or face) value. Examples of zero-coupon bonds … Zero Coupon Bond Calculator – What is the Market Value? P: The par or face value of the zero coupon bond; r: The interest rate of the bond; t: The time to maturity of the bond; Zero Coupon Bond Pricing Example. Let's walk through an example zero coupon bond pricing calculation for the default inputs in the tool. Face value: $1000; Interest Rate: 10%; Time to Maturity: 10 Years, 0 Months ... The Macaulay Duration of a Zero-Coupon Bond in Excel - Investopedia Aug 29, 2022 · The Macaulay duration of a zero-coupon bond is equal to the time to maturity of the bond. Simply put, it is a type of fixed-income security that does not pay interest on the principal amount. Coupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

What does it mean if a bond has a zero coupon rate? - Investopedia Aug 30, 2022 · A bond's coupon rate is the percentage of its face value payable as interest each year. A bond with a coupon rate of zero, therefore, is one that pays no interest. However, this does not mean the ... Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Jan 31, 2022 · Well, for one thing, zero-coupon bonds are bought for a fraction of face value. For example, a $20,000 bond can be purchased for far less than half of that amount. Understanding Bond Prices and Yields - Investopedia Jun 28, 2007 · If you buy a bond at issuance, the bond price is the face value of the bond, and the yield will match the coupon rate of the bond. ... How to Calculate Yield to Maturity of a Zero-Coupon Bond ...

:max_bytes(150000):strip_icc()/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

Post a Comment for "40 zero coupon bond face value"