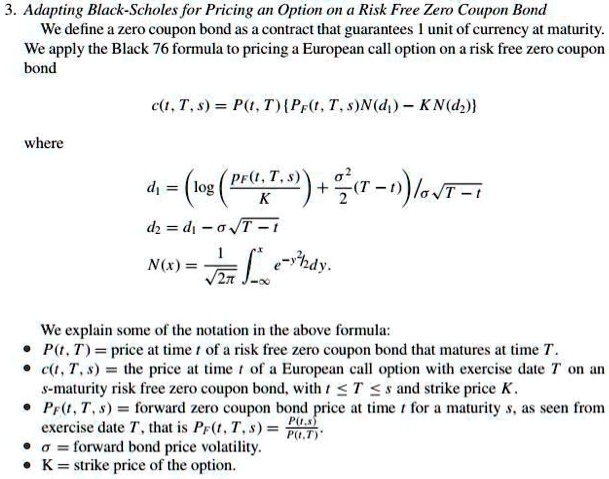

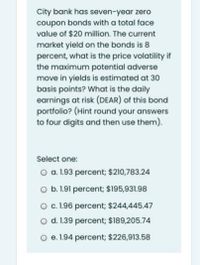

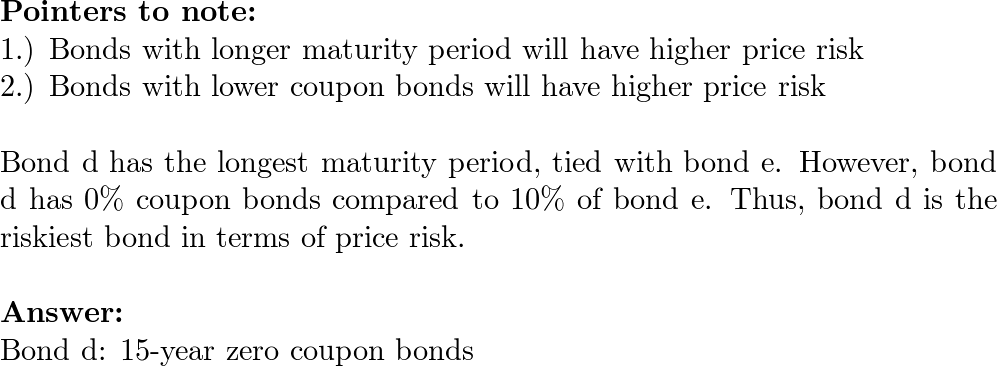

41 risk of zero coupon bonds

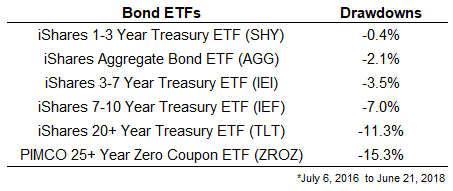

Zero-Coupon Bonds and Taxes - Investopedia Aug 31, 2020 · Zero-coupon bonds may also appeal to investors looking to pass on wealth to their heirs. If a bond selling for $2,000 is received as a gift, it only uses $2,000 of the yearly gift tax exclusion. The One-Minute Guide to Zero Coupon Bonds | FINRA.org 20/10/2022 · That said, zero coupon bonds carry various types of risk. Like virtually all bonds, zero coupon bonds are subject to interest-rate risk if you sell before maturity. If interest rates rise, the value of your zero coupon bond on the secondary market will likely fall. Long-term zeros can be particularly sensitive to changes in interest rates, exposing them to what is known as …

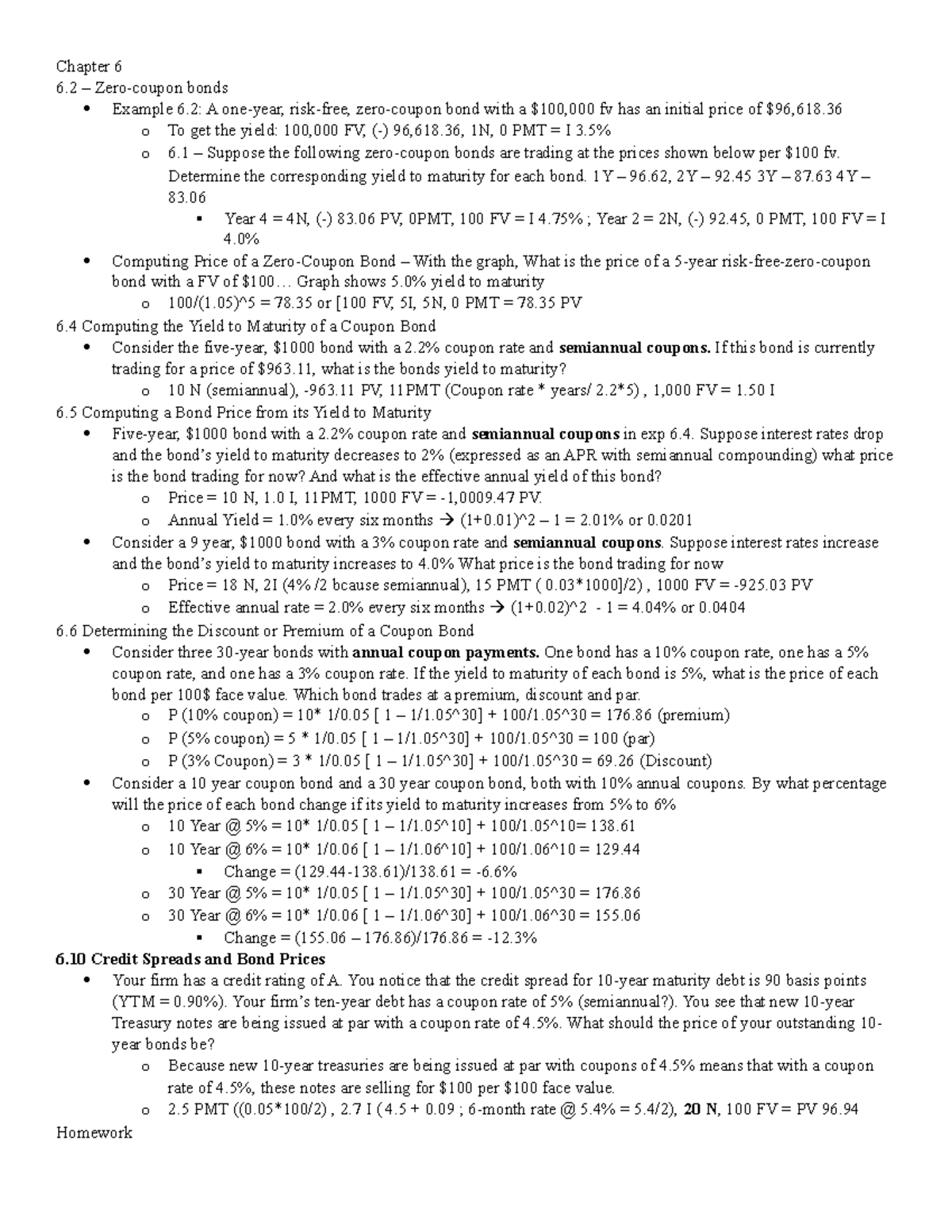

The Basics of Bonds - Investopedia Jul 31, 2022 · Bonds represent the debts of issuers, such as companies or governments. These debts are sliced up and sold to investors in smaller units. For example, a $1 million debt issue may be allocated to ...

Risk of zero coupon bonds

Zero-Coupon Bond - Definition, How It Works, Formula 28/01/2022 · Understanding Zero-Coupon Bonds. As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. To understand why, consider the time value of money.. The time value of money is a concept that illustrates that money is worth more now than an identical sum in the future – an investor would prefer to receive $100 today than … Agency Bonds: Limited Risk And Higher Return - Investopedia Jan 23, 2022 · Agency Bonds: Limited Risk And Higher Return . By. ... Other coupon variations are available, including monthly coupon payments, or interest-at-maturity bonds (akin to zero-coupon bonds). Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero-coupon bond.When the bond reaches maturity, its investor receives its par (or face) value. Examples of zero-coupon bonds include US Treasury …

Risk of zero coupon bonds. What Is a Zero-Coupon Bond? - Investopedia May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ... Bond: Financial Meaning With Examples and How They Are Priced 01/07/2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ... EGP T-Bonds Zero Coupon 24/10/2022 · Risk Management and Information Security; Internal Audit; Procurement; Monetary Policy. Egypt`s Monetary Policy. Monetary Policy Framework ; Monetary Policy Decisions. MPC Meeting Schedule; Press Release; Monetary Policy Report; Inflation. Inflation; Core Inflation; Monthly Inflation Note; Banking Supervision. Overview and Objectives; Organization Chart ; … Zero Coupon Bond Value Calculator: Calculate Price, Yield to ... Economist Gary Shilling mentioned holders of 30-year zero-coupon bonds purchased in the early 1980s outperformed the S&P 500 with dividends reinvested by 500% over the subsequent 30-years as interest rates fell from around 14.6% to around 3%. I started investing in 30 Year zero coupon treasuries. Now, zero coupon bonds don't pay any interest ...

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Jan 31, 2022 · Zero-coupon U.S. Treasury bonds have a poor risk-return profile when held alone. Long-dated zero-coupon Treasury bonds are more volatile than the stock market, but they offer the lower long-run ... Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero-coupon bond.When the bond reaches maturity, its investor receives its par (or face) value. Examples of zero-coupon bonds include US Treasury … Agency Bonds: Limited Risk And Higher Return - Investopedia Jan 23, 2022 · Agency Bonds: Limited Risk And Higher Return . By. ... Other coupon variations are available, including monthly coupon payments, or interest-at-maturity bonds (akin to zero-coupon bonds). Zero-Coupon Bond - Definition, How It Works, Formula 28/01/2022 · Understanding Zero-Coupon Bonds. As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. To understand why, consider the time value of money.. The time value of money is a concept that illustrates that money is worth more now than an identical sum in the future – an investor would prefer to receive $100 today than …

:max_bytes(150000):strip_icc()/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

Post a Comment for "41 risk of zero coupon bonds"