44 zero coupon bond investopedia

Investopedia Video: Zero-Coupon Bond - YouTube Investopedia 218K subscribers Subscribe A debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full... Zero-Coupon Bond Definition - Investopedia A zero-coupon bond, also known as an accrual bond, is a debt security that does not pay interest but instead trades at a deep discount, rendering a profit at maturity, when the bond is redeemed for...

What are Zero coupon bonds? - INSIGHTSIAS What are these special type of zero coupon bonds? These are "non-interest bearing, non-transferable special GOI securities". They have a maturity of 10-15 years and issued specifically to Punjab & Sind Bank. These recapitalisation bonds are special types of bonds issued by the Central government specifically to a particular institution.

Zero coupon bond investopedia

Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond (Also known as Pure Discount Bond or Accrual Bond) refers to those bonds which are issued at a discount to its par value and makes no periodic interest payment, unlike a normal coupon-bearing bond. In other words, its annual implied interest payment is included in its face value which is paid at the maturity of such bond. Zero-Coupon Bond - Definition, How It Works, Formula A zero-coupon bond is a bond that pays no interest. The bond trades at a discount to its face value. Reinvestment risk is not relevant for zero-coupon bonds, but interest rate risk is relevant for the bonds. Understanding Zero-Coupon Bonds As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. OECD Glossary of Statistical Terms - Zero-coupon / deep discount bond ... A zero-coupon/deep discount bond is a debt security with no coupon (zero-coupon) or substantially lower coupon than current interest rates. The bonds are issued at a discount to their nominal value, with the discount reflecting the prevailing market interest rate. In the case of a zero-coupon bond, investors receive at maturity the difference ...

Zero coupon bond investopedia. The Dummies Guide To Zero Coupon Bonds - ED Times Let's look at the very basic, super simple Zero-Coupon Bonds. Zero coupon bonds are probably the simplest financial assets or bonds to value since they only have one cash flow. As the name implies, zero coupon bonds do not have any coupon payments attached with them. The only cash flow for zero-coupon bonds is the face value at maturity. › terms › bBond Discount - Investopedia May 29, 2021 · Bond Discount: The amount by which the market price of a bond is lower than its principal amount due at maturity. This amount, called its par value , is often $1,000. As bond prices are quoted as ... What does it mean if a bond has a zero coupon rate? A zero coupon bond generally has a reduced market price relative to its par value because the purchaser must maintain ownership of the bond until maturity to turn a profit. A bond that sells for... Zero Coupon Bonds - Porter Docs Zero Coupon Bonds. A zero-coupon bond, also known as an accrual bond, is a debt security that does not pay interest but instead trades at a deep discount, rendering a profit at maturity, when the bond is redeemed for its full face value. ... The majority of this content was pulled from Investopedia and modified to better serve Porter users. We ...

Special Zero Coupon Recapitalisation Bonds - Drishti IAS Why in News. Recently, the government has used financial innovation to recapitalise Punjab & Sind Bank by issuing the bank Rs. 5,500 crore worth Special Zero Coupon Recapitalisation Bonds.. Punjab & Sind Bank is a Government of India undertaking.; Key Points. Bank Recapitalisation: It means infusing more capital in state-run banks so that they meet the capital adequacy norms. › terms › cCoupon Definition - Investopedia Apr 02, 2020 · Coupon: The annual interest rate paid on a bond, expressed as a percentage of the face value. Zero-Coupon Convertible - Investopedia A zero-coupon security is a debt instrument which does not make interest payments. An investor purchases this security at a discount and receives the face value of the bond on the maturity date.... Bootstrapping (finance) - Wikipedia In finance, bootstrapping is a method for constructing a (zero-coupon) fixed-income yield curve from the prices of a set of coupon-bearing products, e.g. bonds and swaps.. A bootstrapped curve, correspondingly, is one where the prices of the instruments used as an input to the curve, will be an exact output, when these same instruments are valued using this curve.

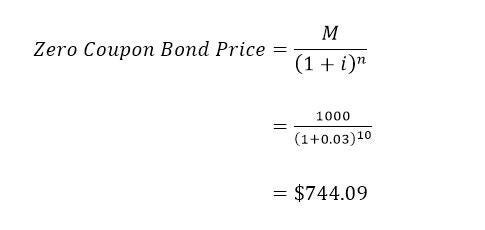

Zero coupon bonds - Chrome IAS A zero-coupon bond is a debt security that does not pay interest but instead trades at a deep discount, rendering a profit at maturity, when the bond is redeemed for its full face value. A zero-coupon bond is also known as an accrual bond. Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Zero-coupon U.S. Treasury bonds can move up significantly when the Fed cuts rates aggressively. 1 These gains can more than offset stock related losses, so Treasury zeros are often an excellent... Zero Coupon Bond Yield: Formula, Considerations, and ... - Investopedia Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The formula would look as follows: =... How to Calculate the Price of a Zero Coupon Bond Second, add 1 to 0.06 to get 1.06. Third, raise 1.06 to the second power to get 1.1236. Lastly, divide the face value of $2,000 by 1.1236 to find that the price to pay for the zero-coupon bond is $1,880. 00:00 00:00.

A contradictory concept on Convexity of Bonds? - Bionic Turtle convexity= (T)* (T+1)* (1/ (1+y)^2) from above we see that convexity of Zero coupon bond varies directly as T (T+1) ~T^2 to be approximate. Thus convexity increases with square of maturity as a matter of fact presented by David. Barbell has more distributed payments at extremes while bullet has one single point of pay.

Zero-Coupon Bond - Assignment Point A zero-coupon bond also called a discount bond or a deep discount bond pays no interest and trades at a discount to its face value. The lender retains the par (or face) value of the bond when it matures. ... investopedia.com; wikipedia; Share ! Facebook Twitter WhatsApp LinkedIn Pin It Email. Related Paper. Annual Report 2006-2007 of Gammon ...

What Is a Zero Coupon Yield Curve? (with picture) A zero coupon bond does not pay interest but instead carries a discount to its face value. The investor therefore receives one payment of the face value of the bond on its maturity. This face value is the equivalent of the principal invested plus interest over the life of the bond.

Zero-Coupon Bond - The Investors Book Definition: A zero-coupon bond, as the name suggests, it is a financial instrument which does not allow a regular interest payment to the investor. Moreover, it is a bond which is issued at a meagre market price (discounted price) in comparison to its face value. And it is redeemable on or after a specified maturity date at the par value itself.

Zero-Coupon Swap Definition - Investopedia A zero-coupon swap is a derivative contract entered into by two parties. One party makes floating payments which changes according to the future publication of the interest rate index (e.g. LIBOR,...

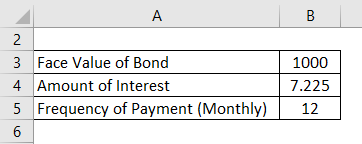

Zero Coupon Bonds - Porter Docs Zero Coupon Bonds. Overview. ZCB pricing

Zero-Coupon Bonds and Taxes - Investopedia A zero-coupon bond will usually have higher returns than a regular bond with the same maturity because of the shape of the yield curve. Zero-coupon bonds are more volatile than coupon bonds, so...

All About Zero Coupon Bonds - Yahoo Finance Zero-coupon bonds are bonds that do not make any interest payments (which investment professionals often refer to as the "coupon") until maturity. For investors, this means that if you make an...

zero coupon - Are pure PIK bonds' payoffs known from the start ... - Investopedia. Therefore, for these bonds to have a reason to exist, I would expect Y to not be known from the start. Is that the case, and if it is : what actually happens when a "coupon" is paid ? If additional bonds issued by the PIK bond issuer are used to pay, does the bond yield depend on the current yield investors ask of this company ...

Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. That definition assumes a positive time value of money. It does not make periodic interest payments or have so-called coupons, hence the term zero coupon bond.

OECD Glossary of Statistical Terms - Zero-coupon / deep discount bond ... A zero-coupon/deep discount bond is a debt security with no coupon (zero-coupon) or substantially lower coupon than current interest rates. The bonds are issued at a discount to their nominal value, with the discount reflecting the prevailing market interest rate. In the case of a zero-coupon bond, investors receive at maturity the difference ...

Zero-Coupon Bond - Definition, How It Works, Formula A zero-coupon bond is a bond that pays no interest. The bond trades at a discount to its face value. Reinvestment risk is not relevant for zero-coupon bonds, but interest rate risk is relevant for the bonds. Understanding Zero-Coupon Bonds As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value.

Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond (Also known as Pure Discount Bond or Accrual Bond) refers to those bonds which are issued at a discount to its par value and makes no periodic interest payment, unlike a normal coupon-bearing bond. In other words, its annual implied interest payment is included in its face value which is paid at the maturity of such bond.

:max_bytes(150000):strip_icc()/dotdash_Final_Par_Yield_Curve_Apr_2020-01-3d27bef7ca0c4320ae2a5699fb798f47.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Par_Yield_Curve_Apr_2020-01-3d27bef7ca0c4320ae2a5699fb798f47.jpg)

Post a Comment for "44 zero coupon bond investopedia"