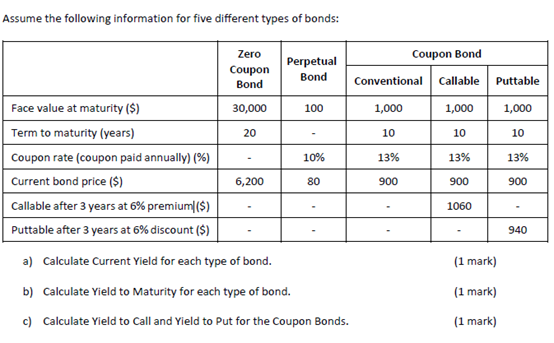

42 perpetual zero coupon bond

Seriously, Money Is Not A Zero Coupon Perpetual - Bond Economics Jul 24, 2016 ... A perpetual bond is a bond that pays a fixed coupon on a fixed schedule (for example, annually, or semi-annually), but has no fixed maturity ... Zero-coupon perpetual bonds: this April Fool is no joke | MoneyWeek Aug 19, 2016 ... The difference between a central bank owning zero-coupon perpetuals and conventional bonds is that the former cannot be sold to withdraw excess ...

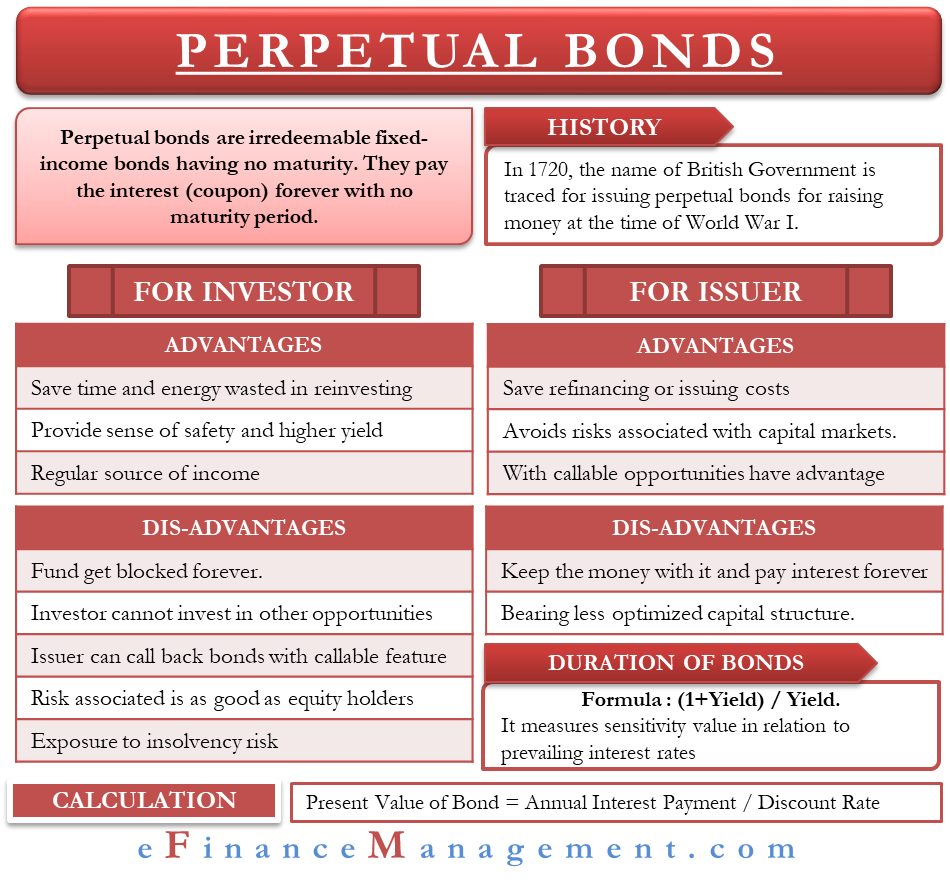

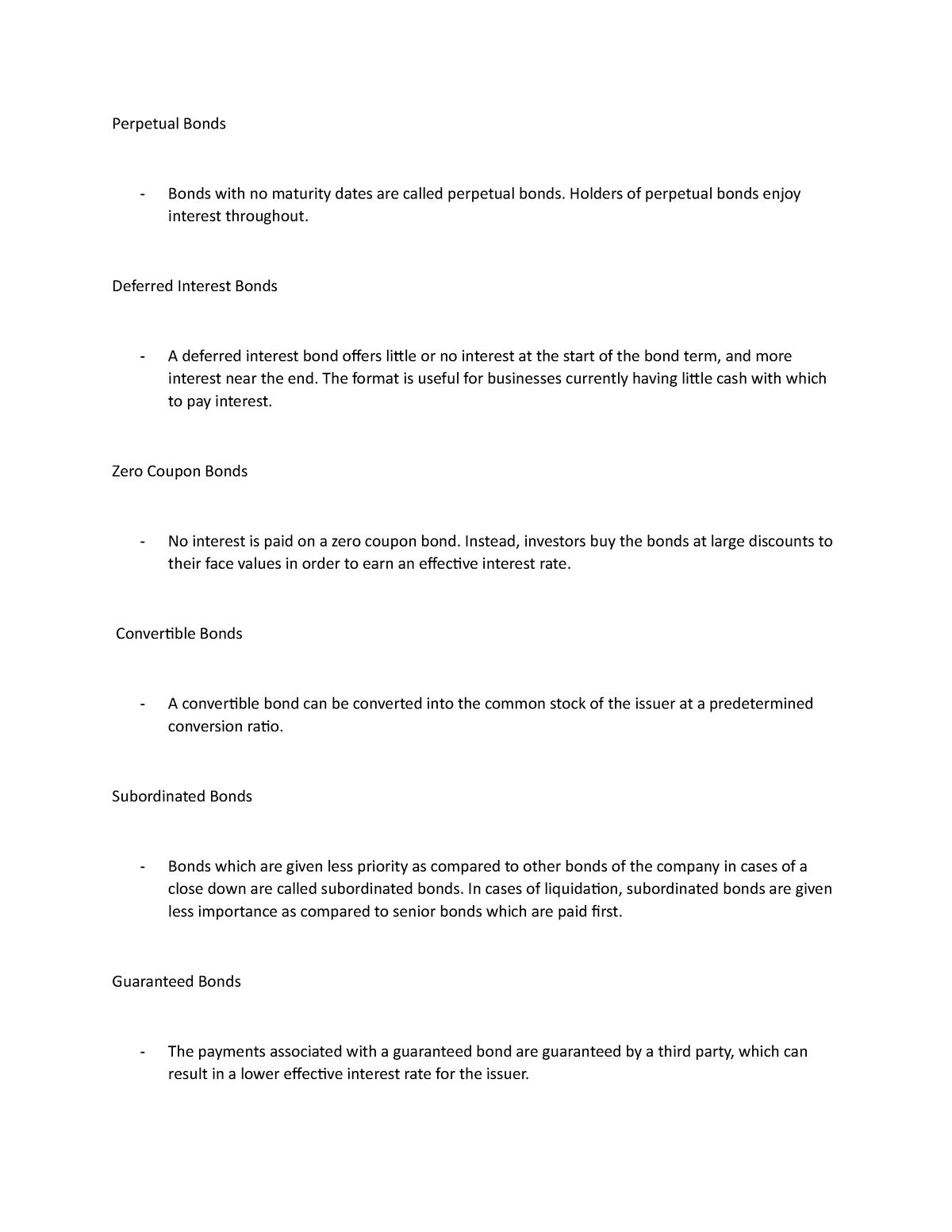

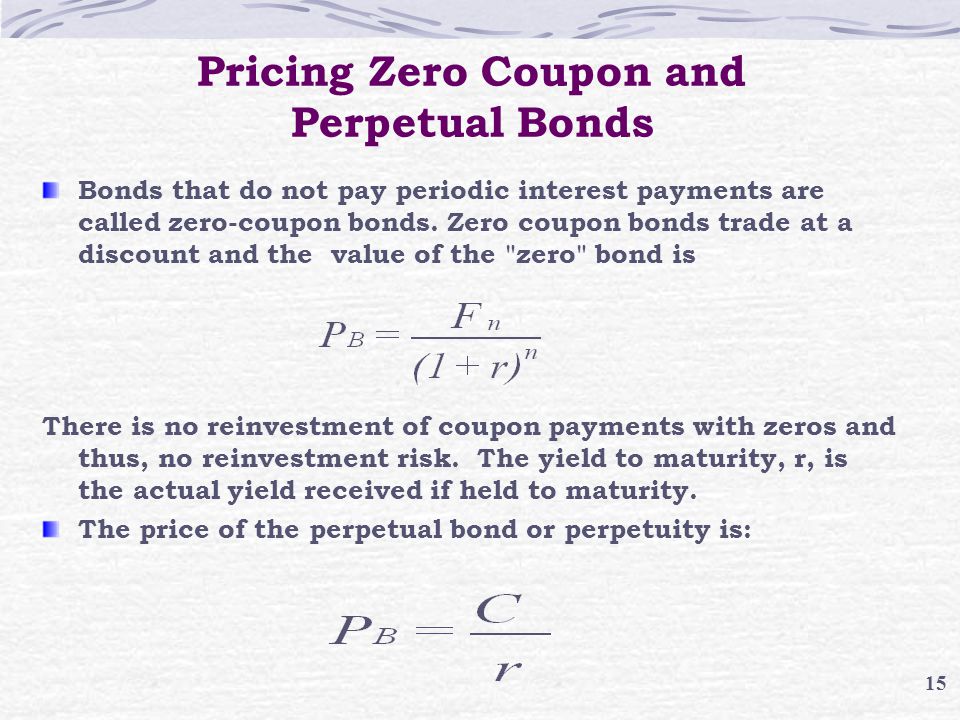

Bond (finance) - Wikipedia Perpetual: no maturity Period. Coupon. The coupon is the interest rate that the issuer pays to the holder. For fixed rate bonds, the coupon is fixed throughout the life of the bond. For floating rate notes, the coupon varies throughout the life of the bond and is based on the movement of a money market reference rate (often LIBOR).

Perpetual zero coupon bond

Perpetual Bonds - Overview, Issuers, Advantages, Disadvantages Oct 17, 2022 ... They pay interest to investors in the form of coupon payments, just as with most bonds, but the bond's principal amount does not come with a set ... Zero-Coupon Bond: Definition, How It Works, and How To Calculate A zero-coupon bond, also known as an accrual bond, is a debt security that does not pay interest but instead trades at a deep discount, rendering a profit ... Coupon (finance) - Wikipedia In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond. Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value. For example, if a bond has a face value of ...

Perpetual zero coupon bond. Chancellor: Zero-coupon bonds are not a joke - Reuters Aug 26, 2016 ... The column teasingly suggested that Washington should issue zero-coupon perpetual bonds, as this would reduce debt service costs. FWDGRP 8.045% Perpetual Corp (USD) - Bondsupermart Bond Information FWD Group Limited operates as an insurance company. ... U.S.$500,000,000 Zero Coupon Subordinated Perpetual Capital Securities. Bond valuation - Wikipedia Therefore, (2) some multiple (or fraction) of zero-coupon bonds, each corresponding to the bond's coupon dates, can be specified so as to produce identical cash flows to the bond. Thus (3) the bond price today must be equal to the sum of each of its cash flows discounted at the discount rate implied by the value of the corresponding ZCB. Lifestyle | Daily Life | News | The Sydney Morning Herald The latest Lifestyle | Daily Life news, tips, opinion and advice from The Sydney Morning Herald covering life and relationships, beauty, fashion, health & wellbeing

Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero-coupon bond. When the bond reaches maturity, its investor receives its par (or face) value. What is the fair price of a perpetual zero-coupon bond? - Quora Feb 27, 2020 ... Normal economic reasoning says a security that never pays any interest and never repays principal has zero value, since it never pays anything. But then someone ... Black–Scholes model - Wikipedia See Bond option § Valuation. Interest - rate curve. In practice, interest rates are not constant—they vary by tenor (coupon frequency), giving an interest rate curve which may be interpolated to pick an appropriate rate to use in the Black–Scholes formula. Another consideration is that interest rates vary over time. FWDGRP ZERO Perpetual Corp (USD) - Bondsupermart Bond Information FWD Group Limited operates as an insurance broker. ... U.S.$164,000,000 Zero Coupon Subordinated Perpetual Capital Securities to be ...

BOLI – The “Zero Coupon Perpetual Bond” BOLI is a bond — a “zero coupon perpetual bond.” What's fascinating about this bond is that neither ABC Insurance Company nor. Buy/Sell Bitcoin, Ethereum | Cryptocurrency Exchange | Gate.io 11-12 Gate.io will Adjust the Funding Interval for FTT/USDT Perpetual; 11-11 The Event Trade APT/USDT Perp and Unlock $20,000 Prize Pool Has Ended | Rewards Has Been Distributed to the Winners; 11-11 Gate.io Trading Fair: Fan Token Session, Collect Soccer Balls & Split $50,000! 11-11 Celebrate the FIFA World Cup 2022 with Gate.io Impossible Finance — The Zero Coupon Perpetual Bond One special type of bond is the “Zero coupon bond” which does not pay interest but is issued at a discount to the face value. It is the face value that is paid ... Coupon (finance) - Wikipedia In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond. Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value. For example, if a bond has a face value of ...

Zero-Coupon Bond: Definition, How It Works, and How To Calculate A zero-coupon bond, also known as an accrual bond, is a debt security that does not pay interest but instead trades at a deep discount, rendering a profit ...

Perpetual Bonds - Overview, Issuers, Advantages, Disadvantages Oct 17, 2022 ... They pay interest to investors in the form of coupon payments, just as with most bonds, but the bond's principal amount does not come with a set ...

Post a Comment for "42 perpetual zero coupon bond"