38 coupon rate and yield

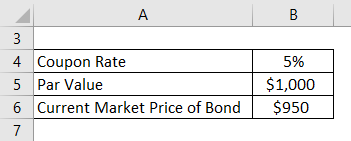

What is the difference coupon rate and yield rate? bonds market coupon rate investment retail investors yield rate. Answer. Determine Coupon Rate, Current Yield, and Yield to Maturity - BrainMass The Garland Corporation has a $1,000 par value bond outstanding with a $90 annual interest payment, a market price of $820 and a maturity date in five years. Find the following: a. The coupon rate. b. The current yield. c.

Difference Between Coupon Rate and Required Return Coupon Rate is the periodical price that the buyer receives until the bond matures. Required Return is the amount paid for the investor to own the risks. The coupon rate is calculated using the formula Coupon rate = ( Total annual payment/par value of bond) * 100. Required Return is calculated by using the beta value.

Coupon rate and yield

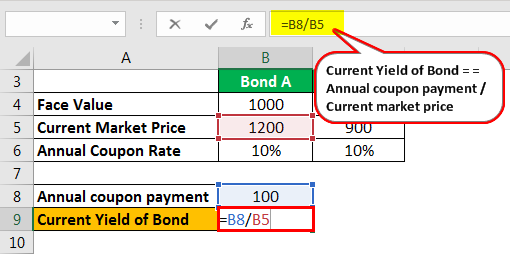

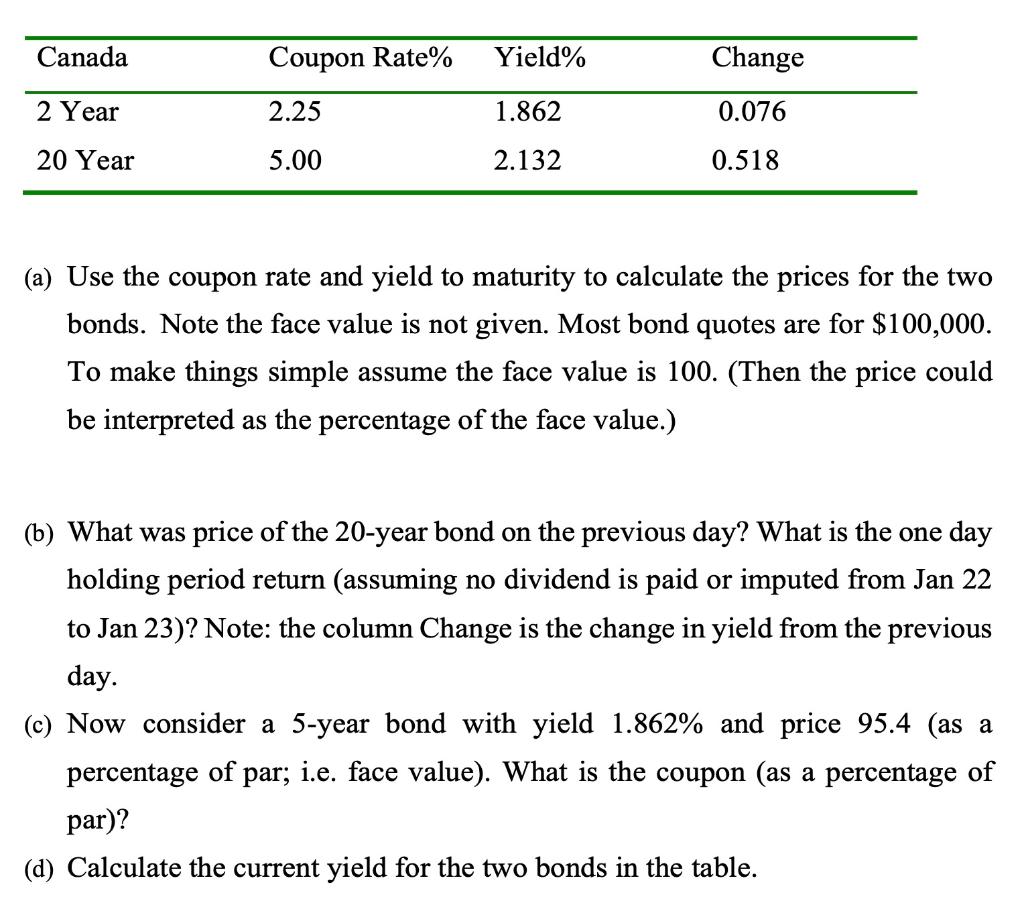

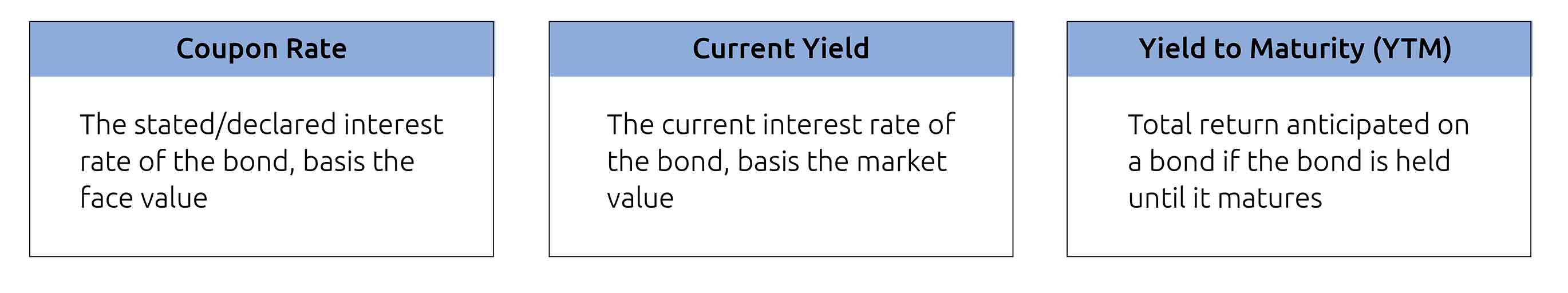

Current Yield vs. Yield to Maturity: What's the Difference? Yield to maturity is a way to compare bonds with different market prices, coupon rates, and maturities. Formula The current yield of a bond is easily calculated by dividing the coupon payment by the price. For example, a bond with a market price of $7,000 that pays $70 per year would have a current yield of 7%. 3 › ask › answersYield to Maturity vs. Coupon Rate: What's the Difference? The coupon rate or yield is the amount that investors can expect to receive in income as they hold the bond. Coupon rates are fixed when the government or company issues the bond, although bonds... calculator.me › savings › zero-coupon-bondsZero Coupon Bond Value Calculator: Calculate Price, Yield to ... Here is an example calculation for the purchase price of a $1,000,000 face value bond with a 10 year duration and a 6% annual interest rate. 20. Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P ...

Coupon rate and yield. Difference between Yield Coupon Rate - Difference Betweenz The yield rate is the annual percentage of return on investment, while the coupon rate is simply the periodic interest payments (coupons) made on a bond or note. When you are looking at investments, it's important to know which one offers you a higher return. However, it's also important to consider other factors such as risk and liquidity. Coupon Rate - Meaning, Calculation and Importance - Scripbox The coupon payments are semi-annual, and the semi-annual payments are INR 50 each. To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100 Coupon Rate = 100 / 500 * 100 = 20% Therefore, the coupon rate for the Company A bond is 20%. What is the Coupon Rate? - Realonomics The coupon rate or yield is the amount that investors can expect to receive in income as they hold the bond. Coupon rates are fixed when the government or company issues the bond. The coupon rate is the yearly amount of interest that will be paid based on the face or par value of the security. 38 coupon rate and yield to maturity - Blogger Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision Coupon Rate = 5-Year Treasury Yield + .05% So if the 5-Year Treasury Yield is 7%, then the coupon rate for this security will be 7.5%. Now, if this coupon is revised every six months and after six months, the 5-Year Treasury Yield is 6.5%, then the revised coupon rate will be 7%.

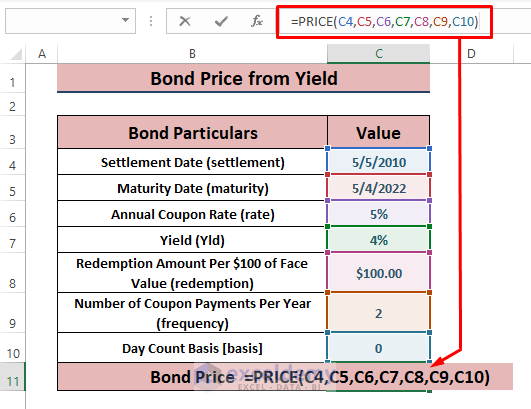

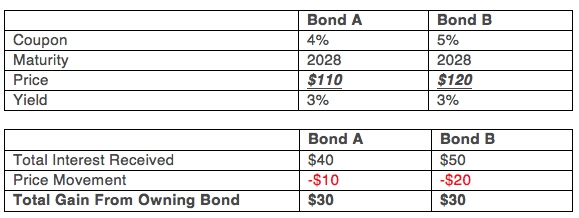

Bond Pricing - Formula, How to Calculate a Bond's Price A bond that sells at a premium (where price is above par value) will have a yield to maturity that is lower than the coupon rate. Alternatively, the causality of the relationship between yield to maturity and price may be reversed. A bond could be sold at a higher price if the intended yield (market interest rate) is lower than the coupon rate. › coupon-rate-formulaCoupon Rate Formula | Step by Step Calculation (with Examples) Formula to Calculate Coupon Rate. Coupon Rate Formula is used for the purpose of calculating the coupon rate of the bond and according to the formula coupon rate of the bond will be calculated by dividing the total amount of annual coupon payments with the par value of the bonds and multiplying the resultant with the 100. Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision Coupon Rate = Reference Rate + Quoted Margin The quoted margin is the additional amount that the issuer agrees to pay over the reference rate. For example, suppose the reference rate is a 5-year Treasury Yield, and the quoted margin is 0.5%, then the coupon rate would be - Coupon Rate = 5-Year Treasury Yield + .05% Difference between YTM and Coupon Rates YTM is the acronym for "yield to maturity", and it measures the rate of return an investor would earn if they held a bond until it reached maturity. YTM accounts for both the interest payments made (the coupon rate) as well as any capital gains or losses. A coupon rate, on the other hand, is simply the interest rate that is paid out on a ...

Bond Yield Definition | U.S. News A bond yield refers to the returns earned by investors on a bond and can be calculated using a variety of methods. Common variations of a bond yield include coupon rate, current yield and yield to ... Difference Between Bond Coupon Rate And Yield To Maturity Feel free to grab difference between bond coupon rate and yield to maturity a glass of sweet tea or a mug of hot cocoa my personal favs! Out of 59 active coupons, this is the best Personalized Ornaments For You coupons available today. Find great designs on durable stickers or create your own custom stickers to express yourself. Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia A bond's coupon rate is the rate of interest it pays annually, while its yield is the rate of return it generates. A bond's coupon rate is expressed as a percentage of its par value. The par value... Coupon Bond - Guide, Examples, How Coupon Bonds Work These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance. Bonds that have higher coupon rates offer investors higher yields on their investment. In the past, such bonds were issued in the form of bearer certificates. This means that the physical possession of the certificate was sufficient proof of ownership.

Bond Basics: Issue Size and Date, Maturity Value, Coupon - The Balance Coupon and Yield to Maturity . The coupon rate is the periodic interest payment that the issuer makes during the life of the bond. For instance, a bond with a $10,000 maturity value might offer a coupon of 5%. Then, you can expect to receive $500 each year until the bond matures. The term "coupon" comes from the days when investors would ...

Coupon Rate Definition - Investopedia The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to maturity...

› finance › coupon-rateCoupon Rate Calculator | Bond Coupon Jul 15, 2022 · As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate; The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment ...

› coupon-rate-bondCoupon Rate of a Bond (Formula, Definition) | Calculate ... Coupon Rate is referred to the stated rate of interest on fixed income Fixed Income Fixed Income refers to those investments that pay fixed interests and dividends to the investors until maturity. Government and corporate bonds are examples of fixed income investments. read more securities such as bonds.

Effective Yield - Overview, Formula, Example, and Bond Equivalent Yield Formula for Calculating the Effective Yield. The formula for calculating the effective yield on a bond purchased: Effective Yield = [1 + (i/n)] n - 1. Where: i - The nominal interest rate on the bond. n - The number of coupon payments received in each year.

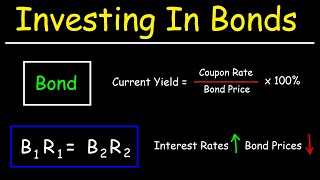

Difference Between Current Yield and Coupon Rate The main difference between the current yield and coupon rate is that the current yield is just an expected return from a bond, and the coupon rate is the actual amount paid regularly for a bond till it gets mature. The Current Yield keeps changing as the market value of the bond changes, but the Coupon Rate of a particular bond remains the same.

Coupon rate definition — AccountingTools A coupon rate is the interest percentage stated on the face of a bond or similar instrument. This is the interest rate that a bond issuer pays to a bond holder, usually at intervals of every six months. The current yield may vary from the coupon rate, depending on the price at which an investor buys a bond.

What Is the Coupon Rate of a Bond? - The Balance This translates to a current yield of 2.73%. What It Means for Individual Investors A bond's coupon rate tells an investor the dollar amount of interest they can expect to receive each year for as long as they hold the bond. This can help in planning your cash flow over the period until the bond matures.

Bond Price Calculator | Formula | Chart To calculate the coupon per period you will need two inputs, namely the coupon rate and frequency. It can be calculated using the following formula: coupon per period = face value * coupon rate / frequency. As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50.

Basics Of Bonds - Maturity, Coupons And Yield - InCharge Debt Solutions Current yield is the bond's coupon yield divided by its market price. To calculate the current yield for a bond with a coupon yield of 4.5 percent trading at 103 ($1,030), divide 4.5 by 103 and multiply the total by 100. You get a current yield of 4.37 percent. Say you check the bond's price later and it's trading at 101 ($1,010).

Difference Between Coupon Rate and Interest Rate Coupon Rate vs Interest Rate The main difference between Coupon Rate and Interest Rate is that the coupon rate has a fixed rate throughout the life of the bond. Meanwhile, the interest rate changes its rate according to the bond yields. The coupon rate is the annual rate of the bond that has to be paid to the holder.

What Is Yield? - The Balance Remember, with stocks, yield is partly a function of share price. For example, a $100 stock that pays a $3 annual dividend yields 3%. If that stock drops in price to $50 and the dividend stays at $3, the yield rises to 6%. While double the yield on an investment looks attractive, a stock price chopped in half might not be.

› coupon-rate-formulaCoupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate = (20 / 100) * 100; Coupon Rate = 20% Now, if the market rate of interest is lower than 20% than the bond will be traded at a premium as this bond gives more value to the investors compared to other fixed income securities.

Of coupons, yields, rates and spreads Part II: SOFR and risk-free rate Coupons, yields and rates are key concepts in fixed income investing - they can help value a fixed income opportunity, better understand market fluctuations, and calculate potential returns of a debt opportunity. These terms also diverge into

Difference Between Coupon Rate and Yield to Maturity The main difference between Coupon Rate and Yield to Maturity (YTM) is that Coupon Rate is the fixed sum of money that a person has to pay at face value. In contrast, Yield to Maturity (YTM) is the amount a person will retrieve after the maturation of their bonds. The Coupon Rate is said to be the same throughout the bond tenure year.

en.wikipedia.org › wiki › Current_yieldCurrent yield - Wikipedia The concept of current yield is closely related to other bond concepts, including yield to maturity (YTM), and coupon yield. When a coupon-bearing bond sells at; a discount: YTM > current yield > coupon yield; a premium: coupon yield > current yield > YTM; par: YTM = current yield = coupon yield. For zero-coupon bonds selling at a discount, the ...

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions.

calculator.me › savings › zero-coupon-bondsZero Coupon Bond Value Calculator: Calculate Price, Yield to ... Here is an example calculation for the purchase price of a $1,000,000 face value bond with a 10 year duration and a 6% annual interest rate. 20. Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P ...

› ask › answersYield to Maturity vs. Coupon Rate: What's the Difference? The coupon rate or yield is the amount that investors can expect to receive in income as they hold the bond. Coupon rates are fixed when the government or company issues the bond, although bonds...

Current Yield vs. Yield to Maturity: What's the Difference? Yield to maturity is a way to compare bonds with different market prices, coupon rates, and maturities. Formula The current yield of a bond is easily calculated by dividing the coupon payment by the price. For example, a bond with a market price of $7,000 that pays $70 per year would have a current yield of 7%. 3

/dotdash_Final_Yield_to_Worst_YTW_Oct_2020-01-cabc0d0cf5b64ef0b4f72afb4888b3aa.jpg)

![PDF] Zero Coupon Yield Curve Estimation with the Package ...](https://d3i71xaburhd42.cloudfront.net/099642ebfde435cc2d7b668516eea73c11bbd53b/13-Figure2-1.png)

Post a Comment for "38 coupon rate and yield"