44 zero coupon convertible bond

Track Bond Prices, New Bond Issues and Bond News - Track Live Bond ... Shimao Defaults On $400mn Zero Coupon Bond Principal. Shimao Group has failed to fulfill its obligations to make a principal payment on its $400m zero-coupon bond that was due on June 14, according to the Credit Derivatives Determinations Committee. This default is the latest in a string of problems for the Chinese... South Africa Government Bonds - Yields Curve The South Africa 10Y Government Bond has a 10.425% yield.. 10 Years vs 2 Years bond spread is 407 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 4.75% (last modification in May 2022).. The South Africa credit rating is BB-, according to Standard & Poor's agency.. Current 5-Years Credit Default Swap quotation is 313.76 and implied probability of default is 5.23%.

Gun Shooting Gift Experience We hand-verify each 1Hour Break coupon code on our site to ensure it provides a valid discount at shop. This promotion is available only to customers located in, and with billing addresses in, the United States. ... High-yield debt Inflation-indexed bond Inverse gun shooting gift experience floating rate note Perpetual bond Puttable bond ...

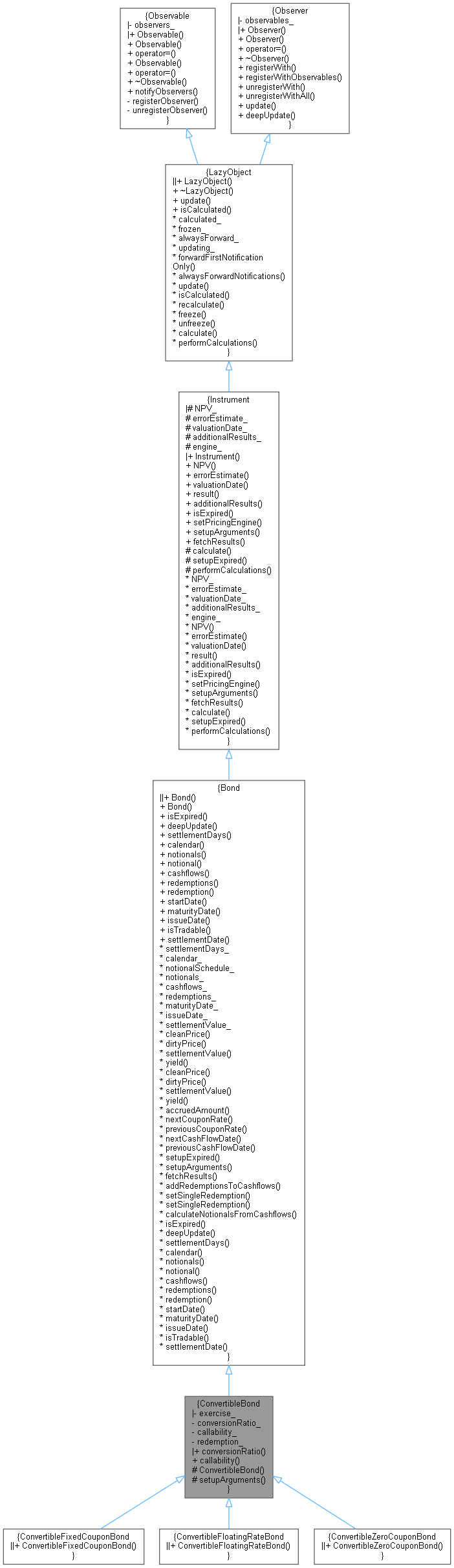

Zero coupon convertible bond

ChangYou.com In addition, Changyou will provide US$30 million in funding to MoboTap by purchasing a zero-coupon convertible bond due in five years. Changyou will have the option, exercisable at any time when the bond is outstanding, to convert all or any part of the unpaid principal into shares of MoboTap at a conversion price that would result in Changyou ... イージー株マップ (5401)日本製鉄 適時開示 (PDF) Announcement Regarding Adjustment of Conversion Price for Zero Coupon Convertible Bonds Due 2024 and Zero Coupon Convertible Bonds Due 2026 (2022/06/23 15:00) (PDF) 2024年満期ユーロ円建転換社債型新株予約権付社債及び2026年満期ユーロ円建転換社債型新株予約権付社債の転換価額の調整に関するお知らせ (2022/06 ... › terms › zZero-Coupon Bond Definition - Investopedia Nov 11, 2021 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

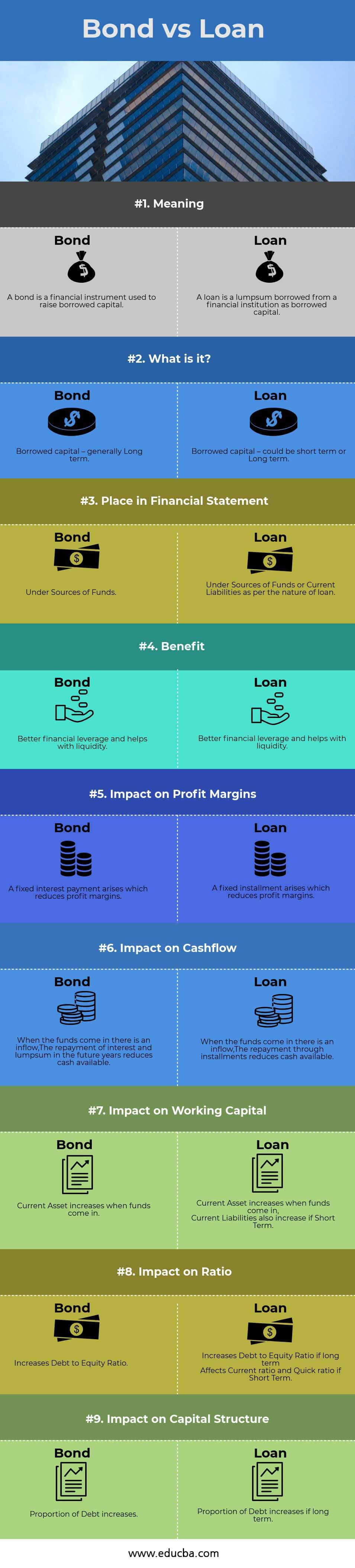

Zero coupon convertible bond. Bond (finance) - Wikipedia In finance, a bond is a type of security under which the issuer owes the holder a debt, and is obliged - depending on the terms - to repay the principal (i.e. amount borrowed) of the bond at the maturity date as well as interest (called the coupon) over a specified amount of time.Interest is usually payable at fixed intervals (semiannual, annual, and less frequently at other periods). › us › productsiShares Convertible Bond ETF | ICVT Jun 30, 2022 · The iShares Convertible Bond ETF seeks to track the investment results of an index composed of U.S. dollar-denominated convertible securities, specifically cash pay bonds, with outstanding issue sizes greater than $250 million. en.wikipedia.org › wiki › Yield_to_maturityYield to maturity - Wikipedia Then continuing by trial and error, a bond gain of 5.53 divided by a bond price of 99.47 produces a yield to maturity of 5.56%. Also, the bond gain and the bond price add up to 105. Finally, a one-year zero-coupon bond of $105 and with a yield to maturity of 5.56%, calculates at a price of 105 / 1.0556^1 or 99.47. Coupon-bearing Bonds › terms › fForeign Currency Convertible Bond (FCCB) - Investopedia Aug 17, 2020 · Foreign Currency Convertible Bond - FCCB: A foreign currency convertible bond (FCCB) is a type of convertible bond issued in a currency different than the issuer's domestic currency. In other ...

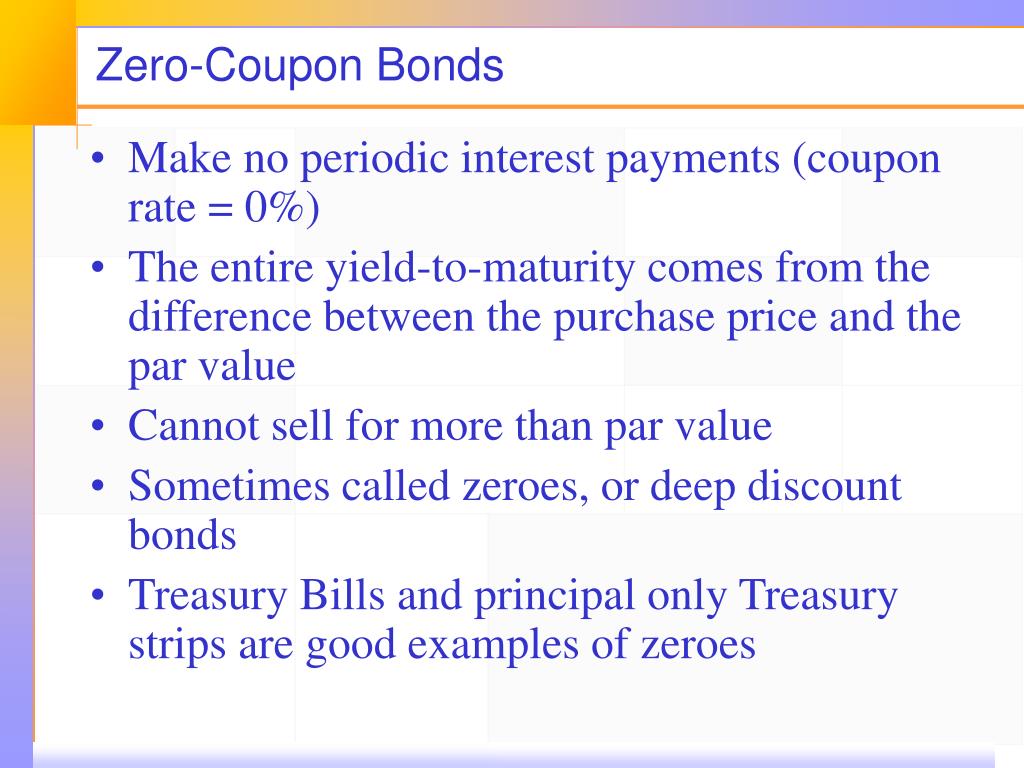

Your Complete Guide to Corporate Bonds - The Motley Fool A corporate bond is a loan to a company for a predetermined period, with a predetermined interest yield it will pay. In return, the company agrees to pay interest (typically twice per year) and ... Tax Free Bond - REC Limited Foreign Currency Bonds. Post-issuance certification from Climate Bond Initiative, London; REC Green Bond Framework; Certificate from Climate Bond Initiative, London; Annual Update Report for Green Bonds as on March 31, 2021; Tax Free Bond; Infrastructure Bonds; Taxable Bond; Forms for Bonds; Market Linked Debentures Bond Key Terms (With Types and Methods of Investing) Convertible bonds: These are bonds which have the general characteristics of a traditional bond such as a coupon and maturity date, but the bondholder can choose to convert these bonds into shares instead of the issuer repaying the bond. Zero-coupon bonds: Rather than paying interest periodically, you can purchase these bonds at a discounted ... Asset Swapped Convertible Option Transaction (ASCOT) - Investopedia Asset Swapped Convertible Option Transaction - ASCOT: An option on a convertible bond that is used to separate a convertible bond into its two components: 1) a bond and 2) an option to acquire ...

Brazil Government Bonds - Yields Curve The Brazil 10Y Government Bond has a 13.038% yield. 10 Years vs 2 Years bond spread is -87.5 bp. Yield Curve is inverted in Long-Term vs Short-Term Maturities. Central Bank Rate is 13.25% (last modification in June 2022). The Brazil credit rating is BB-, according to Standard & Poor's agency. Current 5-Years Credit Default Swap quotation is 291 ... General Announcement :: Notice regarding Adjustment of Conversion Price ... General Announcement :: Notice regarding Adjustment of Conversion Price for Zero Coupon Convertible Bonds Due 2023 and 2025 Malaysia Government Bonds - Yields Curve Last Update: 4 Jul 2022 14:15 GMT+0. The Malaysia 10Y Government Bond has a 4.211% yield. Central Bank Rate is 2.00% (last modification in May 2022). The Malaysia credit rating is A-, according to Standard & Poor's agency. Current 5-Years Credit Default Swap quotation is 57.19 and implied probability of default is 0.95%. General Announcement :: Notice Regarding Adjustment of Conversion Price ... General Announcement :: Notice Regarding Adjustment of Conversion Price forZero Coupon Convertible Bonds due 2023

MUCCX: Victory INCORE Total Return Bond Fund Class C - zacks.com Get the lastest Class Information for Victory INCORE Total Return Bond Fund Class C from Zacks Investment Research ... zero coupon bonds, debentures and convertible debentures and stripped ...

Bond Statistics - Monetary Authority of Singapore Bond Statistics. Get daily closing prices, historical auction data and other statistics for Singapore Government Securities (SGS) bonds. Daily SGS Prices. Historical SGS Prices and Yields - All Issues.

› ~zz1802 › Finance 303Chapter 6 -- Interest Rates Discount bond: a bond that sells below its par value Premium bond: a bond that sell above its par value (2) Yield to maturity (YTM): the return from a bond if it is held to maturity Example: a 10-year bond carries a 6% coupon rate and pays interest semiannually. The market price of the bond is $910.00. What should be YTM for the bond?

What you should know about Bonds? - Learn with Anjali Convertible Bonds. Convertible bonds are a type of coupon bond that offers investors the option to convert the bonds into common shares, which confer an ownership interest in the company issuing the bonds. This option is at a pre-set price, within a specified time frame. ... Investment Profile of Zero-Coupon Bonds .

How Does Preferred Stock Work? - Investopedia Preferred stock is attractive as it offers higher fixed-income payments than bonds with a lower investment per share. Preferred stock often has a callable feature which allows the issuing ...

Yageo : Announcement of the conversion price adjustment for the ECB. Become a member for free. Sign up. Become a member for free

Thengamara Mohila Sabug Sangha Non-Convertible Zero Coupon Bond IPO ... Thengamara Mohila Sabug Sangha Non-Convertible Zero Coupon Bond IPO shares has been credited into respective BO accounts on 04-JUL-22. Share holders are advised to check updated balance with their respective DPs. Last edited on: 04 July, 2022. Related Articles.

General Announcement::Notice regarding Adjustment of Conversion Price ... Notice regarding Adjustment of Conversion Price for Zero Coupon Convertible Bonds Due 2023 and 2025 Announcement Reference SG220629OTHRUP44 Submitted By (Co./ Ind. Name) Shohei Komiya Designation Manager, Finance Dept Description (Please provide a detailed description of the event in the box below)

Post a Comment for "44 zero coupon convertible bond"