42 ytm for coupon bond

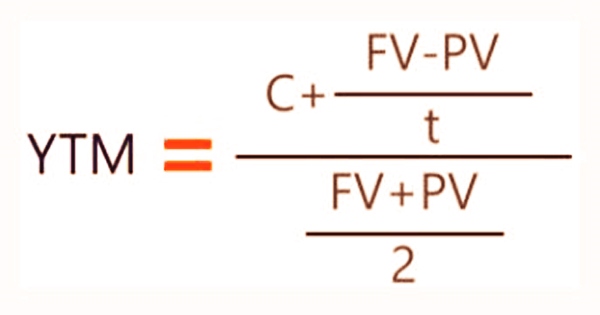

How to Calculate Yield to Maturity: 9 Steps (with Pictures) The coupon payment is $100 ( ). The face value is $1,000, and the price is $920. The number of years to maturity is 10. [2] Use the formula: Using this calculation, you arrive at an approximate yield to maturity of 11.25 percent. 3 Check the validity of your calculation. Plug the yield to maturity back into the formula to solve for P, the price. Coupon Rate Calculator | Bond Coupon And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate. The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value. For Bond A, the coupon rate is $50 / $1,000 = 5%. Even though you now know how to find ...

Understanding Coupon Rate and Yield to Maturity of Bonds To translate this to quarterly payment, first, multiply the Coupon Rate net of 20% final withholding taxes by the face value (1.900% x 1,000,000). Then, divide the resulting annual amount by 4. Here's a sample of how you can compute your expected coupon income from your bond: Php 4,750.00 is the income you can expect to receive quarterly.

Ytm for coupon bond

Bond Yield Definition | U.S. News Using the earlier example of a $10,000 face value bond paying a 5% coupon but with a current face value of $8,333.33, the yield to maturity would be roughly 7.4% if 10 years were remaining until ... Yield to Maturity (YTM): Formula and Excel Calculator Annual Coupon (C) = 3.0% × $1,000 = $30 Yield to Maturity (YTM) Example Calculation With all required inputs complete, we can calculate the semi-annual yield to maturity (YTM). Semi-Annual Yield-to-Maturity (YTM) = [$30 + ($1,000 - $1,050) / 20] / [ ($1,000 + $1,050) / 2] Semi-Annual YTM = 2.7% Coupon Rate - Learn How Coupon Rate Affects Bond Pricing If the issuer sells the bond for $1,000, then it is essentially offering investors a 20% return on their investment, or a one-year interest rate of 20%. $1,200 face value - $1,000 bond price = $200 return on investment when the bondholder is paid the face value amount at maturity. $200 = 20% return on the $1,000 purchase price.

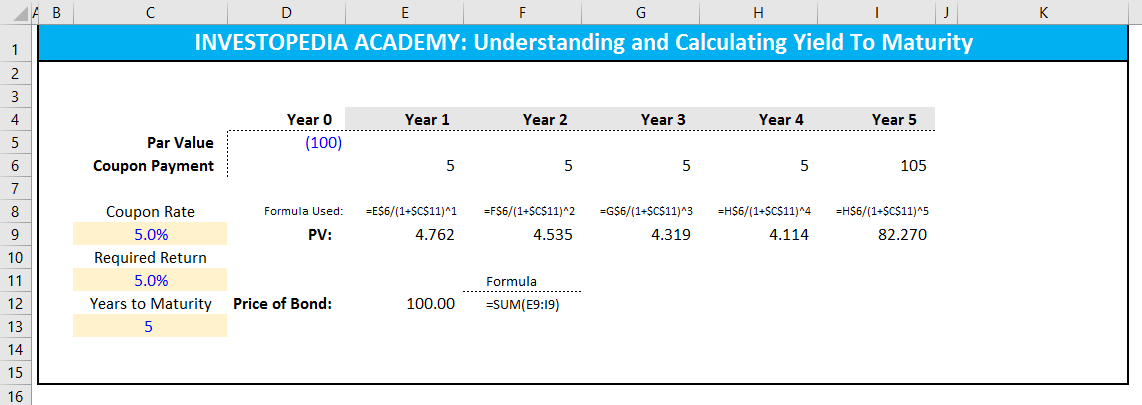

Ytm for coupon bond. Yield to Maturity | Formula, Examples, Conclusion, Calculator The approximate yield to maturity of this bond is 11.25%, which is above the annual coupon rate of 10% by 1.25%. You can then use this value as the rate (r) in the following formula: C = future cash flows/coupon payments r = discount rate (the yield to maturity) F = Face value of the bond n = number of coupon payments Yield to Maturity Calculator | Calculate YTM The YTM can be thought of as the rate of return on a bond. If you hold the bond to maturity after buying it in the market and are able to reinvest the coupons at the YTM, the YTM will be the internal rate of return (IRR) of your bond investments. Yield to Maturity vs. Coupon Rate: What's the Difference? The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A... Yield to Maturity (YTM) - Meaning, Formula & Calculation Using the YTM formula, the required yield to maturity can be determined. 700 = 40/ (1+YTM)^1 + 40/ (1+YTM)^2 + 1000/ (1+YTM)^2 The Yield to Maturity (YTM) of the bond is 24.781% After one year, the YTM of the bond is 24.781% instead of 5.865%. Hence changing market conditions like inflation, interest rate changes, downgrades etc affect the YTM.

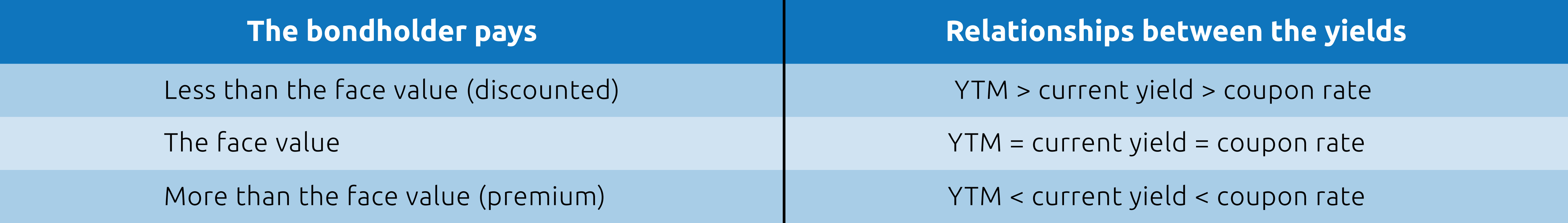

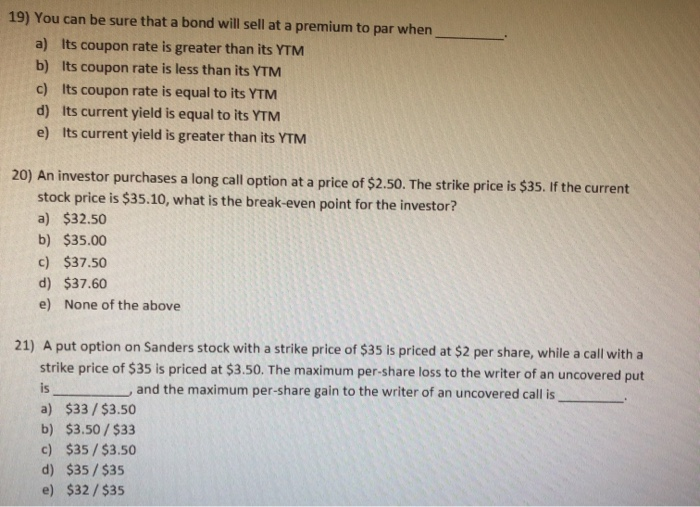

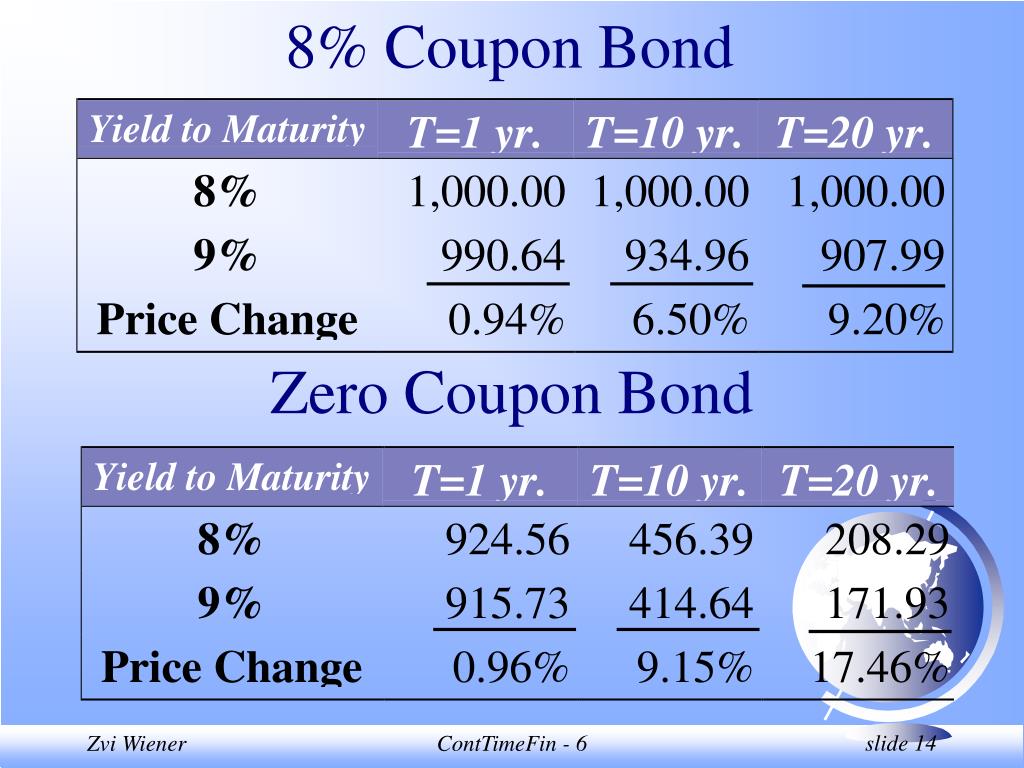

Coupon Rate, Current Yield, YTM, and Market Price for Discount Bond ... Coupon Rate, Current Yield, YTM, and Market Price for Discount BondResource Multiple Languages: ... Yield to Maturity (YTM) - Definition, Formula, Calculations Use the below-given data for calculation of YTM We can use the above formula to calculate approximate yield to maturity. Coupons on the bond will be $1,000 * 8%, which is $80. Yield to Maturity (Approx) = (80 + (1000 - 94) / 12 ) / ( (1000 + 940) / 2) YTM will be - Example #2 FANNIE MAE is one of the famous brands that are trading in the US market. Valuing Bonds | Boundless Finance | | Course Hero If a bond's coupon rate is equal to its YTM, then the bond is selling at par. Calculating YTM Formula for yield to maturity: Yield to maturity(YTM) = [(Face value/Bond price) 1/Time period]-1 As can be seen from the formula, the yield to maturity and bond price are inversely correlated. Bond Yield to Maturity (YTM) Calculator - DQYDJ This makes calculating the yield to maturity of a zero coupon bond straight-forward: Let's take the following bond as an example: Current Price: $600. Par Value: $1000. Years to Maturity: 3. Annual Coupon Rate: 0%. Coupon Frequency: 0x a Year. Price =. (Present Value / Face Value) ^ (1/n) - 1 =.

Yield to Maturity Calculator | Good Calculators P is the price of a bond, C is the periodic coupon payment, r is the yield to maturity (YTM) of a bond, B is the par value or face value of a bond, Y is the number of years to maturity. Example 2: Suppose a bond is selling for $980, and has an annual coupon rate of 6%. It matures in five years, and the face value is $1000. What is the Yield to ... When is a bond's coupon rate and yield to maturity the same? The annual coupon rate for IBM bond is therefore equal to $20 ÷ $1000 = 2%. The coupons are fixed; no matter what price the bond trades for, the interest payments always equal $20 per year. So if... How to Calculate the Price of Coupon Bond? - WallStreetMojo Mathematically, it the price of a coupon bond is represented as follows, Coupon Bond = ∑i=1n [C/ (1+YTM)i + P/ (1+YTM)n] Coupon Bond = C * [1- (1+YTM)-n/YTM + P/ (1+YTM)n] You are free to use this image on your website, templates, etc, Please provide us with an attribution link where C = Periodic coupon payment, P = Par value of bond, Difference Between YTM and Coupon rates Summary: 1. YTM is the rate of return estimated on a bond if it is held until the maturity date, while the coupon rate is the amount of interest paid per year, and is expressed as a percentage of the face value of the bond. 2. YTM includes the coupon rate in its calculation. Author.

How to calculate yield to maturity in Excel (Free Excel Template) The coupon rate is 6%. But as payment is done twice a year, the coupon rate for a period will be 6%/2 = 3%. So, pmt will be $1000 x 3% = $30. PV = Present value of the bond. It is the amount that you spend to buy a bond. So, it is negative in the RATE function. FV = Future value of the bond. It is actually the face value of the bond.

Solved What is the YTM of a twenty-year zero coupon bond | Chegg.com Expert Answer. 5.54% Face value of bond is $ 1000 which is paid at the end of maturit …. View the full answer. What is the YTM of a twenty-year zero coupon bond which is currently selling for $340? 5.85% 5.75% 5.54% 5.68%.

The Returns on a Bond - YTM - The Fixed Income The bond price is calculated from the yield to maturity of the bond, as that is the effective return on the bond. The formula, YTM = C1/ (1+YTM)^1 + C2/ (1+YTM)^2 + C3/ (1+YTM)^3 + ……+ Cn/ (1+YTM)^n + Maturity value/ (1+YTM)^n Here 'C' is the coupon or each installment of interest received,

bond - Why does the YTM equal the coupon rate at par? - Quantitative ... Intuitively and academically, a bond cannot be worth more than the sum of the future cashflows plus future value. In the case of yield equaling coupon rate, the price is equal to par because the rate at which you are discounting makes it so that the sum of the discounted cashflows and discounted par equal present par. Understanding this, by ...

Zero-Coupon Bond: Formula and Excel Calculator To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Zero-Coupon Bond YTM Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1 Zero-Coupon Bond Risks

Yield to Maturity (YTM) Definition & Example | InvestingAnswers The bond will mature in 6 years and the coupon rate is 5%. To determine the YTM, we'll use the formula mentioned above: YTM = t√$1,500/$1,000 - 1 The estimated YTM for this bond is 13.220%. How Yield to Maturity Is Calculated (for Zero Coupon Bonds) Since zero coupon bonds don't have recurring interest payments, they don't have a coupon rate.

Yield to Maturity (YTM) - Overview, Formula, and Importance The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below: The approximated YTM on the bond is 18.53%. Importance of Yield to Maturity

How to Calculate Yield to Maturity of a Zero-Coupon Bond The formula for calculating the yield to maturity on a zero-coupon bond is: Yield To Maturity= (Face Value/Current Bond Price)^ (1/Years To Maturity)−1 Zero-Coupon Bond YTM Example Consider a...

Important Differences Between Coupon and Yield to Maturity The yield increases from 2% to 4%, which means that the bond's price must fall. Keep in mind that the coupon is always 2% ($20 divided by $1,000). That doesn't change, and the bond will always payout that same $20 per year. But when the price falls from $1,000 to $500, the $20 payout becomes a 4% yield ($20 divided by $500 gives us 4%).

a) A \( 10 \% \) coupon bond with 1000 price. What is | Chegg.com b) A 10% consol (perpetuity) with 1000 price. What is the return of the consol for one year if the YTM was initially 10% and decreased at the end of year to 5% ? c) Compare the return of the consol to the return of coupon bond and explain why there is a difference between the two returns. Hint: Calculate the initial price and end-of-period ...

Yield to Maturity (YTM) Definition - Investopedia Because YTM is the interest ratean investor would earn by reinvesting every coupon payment from the bond at a constant interest rate until the bond's maturity date, the present value of all the...

Current Yield vs. Yield to Maturity - Investopedia For example, if an investor buys a 6% coupon rate bond (with a par value of $1,000) for a discount of $900, the investor earns annual interest income of ($1,000 X 6%), or $60. The current yield is...

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing If the issuer sells the bond for $1,000, then it is essentially offering investors a 20% return on their investment, or a one-year interest rate of 20%. $1,200 face value - $1,000 bond price = $200 return on investment when the bondholder is paid the face value amount at maturity. $200 = 20% return on the $1,000 purchase price.

Yield to Maturity (YTM): Formula and Excel Calculator Annual Coupon (C) = 3.0% × $1,000 = $30 Yield to Maturity (YTM) Example Calculation With all required inputs complete, we can calculate the semi-annual yield to maturity (YTM). Semi-Annual Yield-to-Maturity (YTM) = [$30 + ($1,000 - $1,050) / 20] / [ ($1,000 + $1,050) / 2] Semi-Annual YTM = 2.7%

Bond Yield Definition | U.S. News Using the earlier example of a $10,000 face value bond paying a 5% coupon but with a current face value of $8,333.33, the yield to maturity would be roughly 7.4% if 10 years were remaining until ...

/GettyImages-810720992-f4dcb14dc2674174a84be79d0d538f85.jpg)

Post a Comment for "42 ytm for coupon bond"