42 coupon on a bond

Bond Coupon Value Calculation After the huge volume of tweets coming in bond coupon value calculation caused problems reading from and writing to these databases, the company decided that the system needed re-engineering. Products price comparison sites are also the example of such lilli putt coon rapids coupons scenarios where people visit to be sure that they are paying ... Deferred Coupon Bonds | Definition, How it works? Types, Advantages Deferred coupon bonds are ones where interest is paid at maturity. The capital structure of a business needs certain financial instruments on which the interest can be deferred. The traditional plain vanilla bond pays interest periodically. It can be yearly, semi-annually, or quarterly depending upon the company's financial policies.

Advantages and Risks of Zero Coupon Treasury Bonds Zero-coupon bonds are also appealing for investors who wish to pass wealth on to their heirs but are concerned about income taxes or gift taxes. If a zero-coupon bond is purchased for $1,000 and...

Coupon on a bond

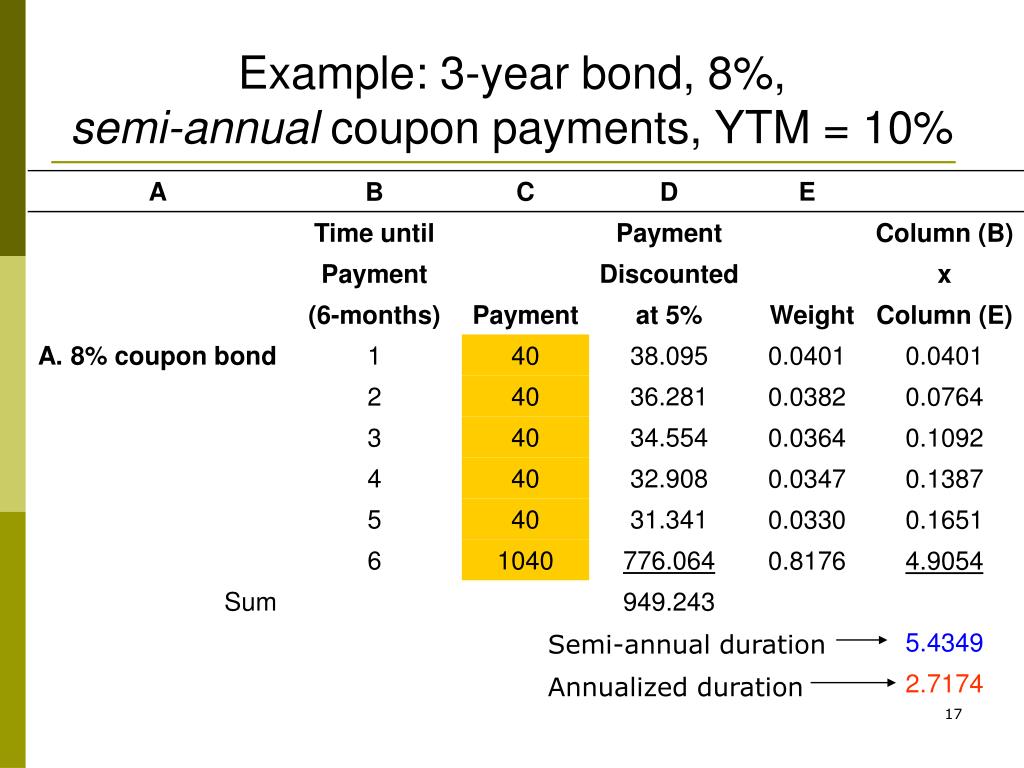

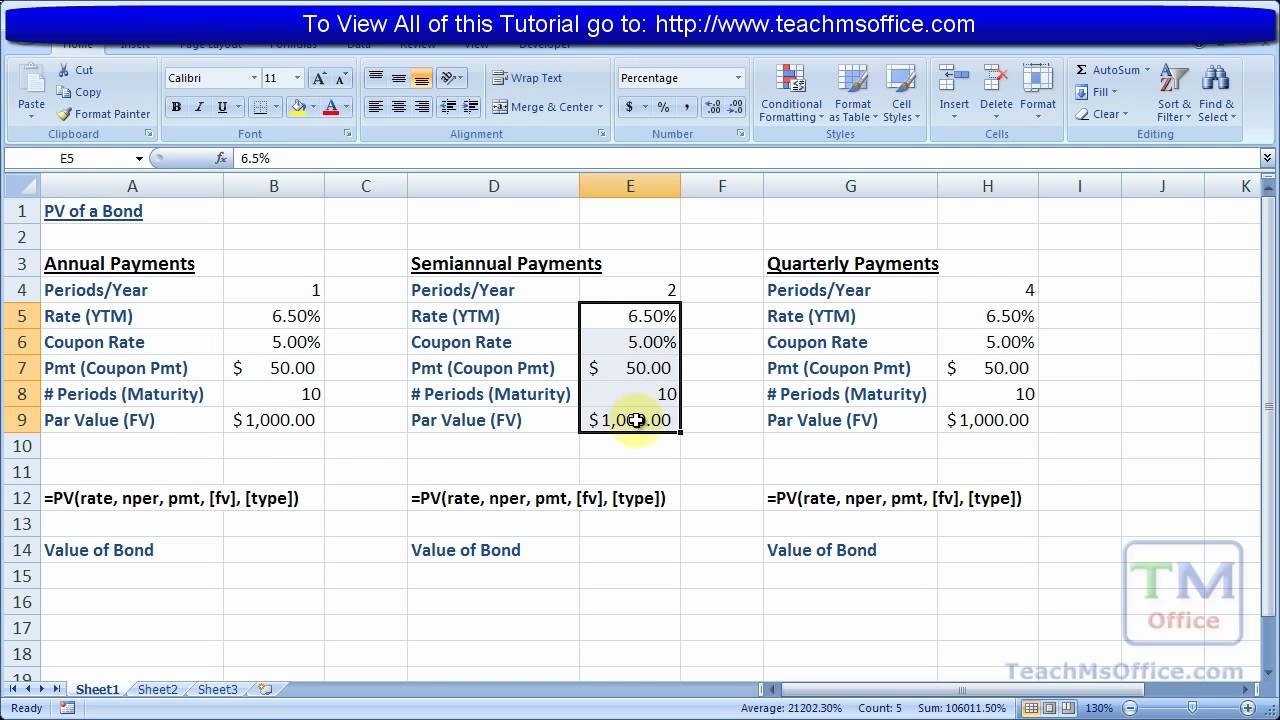

› terms › zZero-Coupon Bond Definition - Investopedia Regular bonds, which are also called coupon bonds, pay interest over the life of the bond and also repay the principal at maturity. A zero-coupon bond does not pay interest but instead trades at a... exploringfinance.com › bond-duration-calculatorBond Duration Calculator - Exploring Finance PV = Bond price = 963.7; FV = Bond face value = 1000; C = Coupon rate = 6% or 0.06; Additionally, since the bond matures in 2 years, then for a semiannual bond, you'll have a total of 4 coupon payments (one payment every 6 months), such that: t 1 = 0.5 years; t 2 = 1 years; t 3 = 1.5 years; t 4 =t n = 2 years dqydj.com › bond-pricing-calculatorBond Price Calculator – Present Value of Future Cashflows - DQYDJ Bond Face Value/Par Value - Par or face value is the amount a bondholder will get back when a bond matures. Annual Coupon Rate - The annual coupon rate is the posted interest rate on the bond. In reverse, this is the amount the bond pays per year divided by the par value.

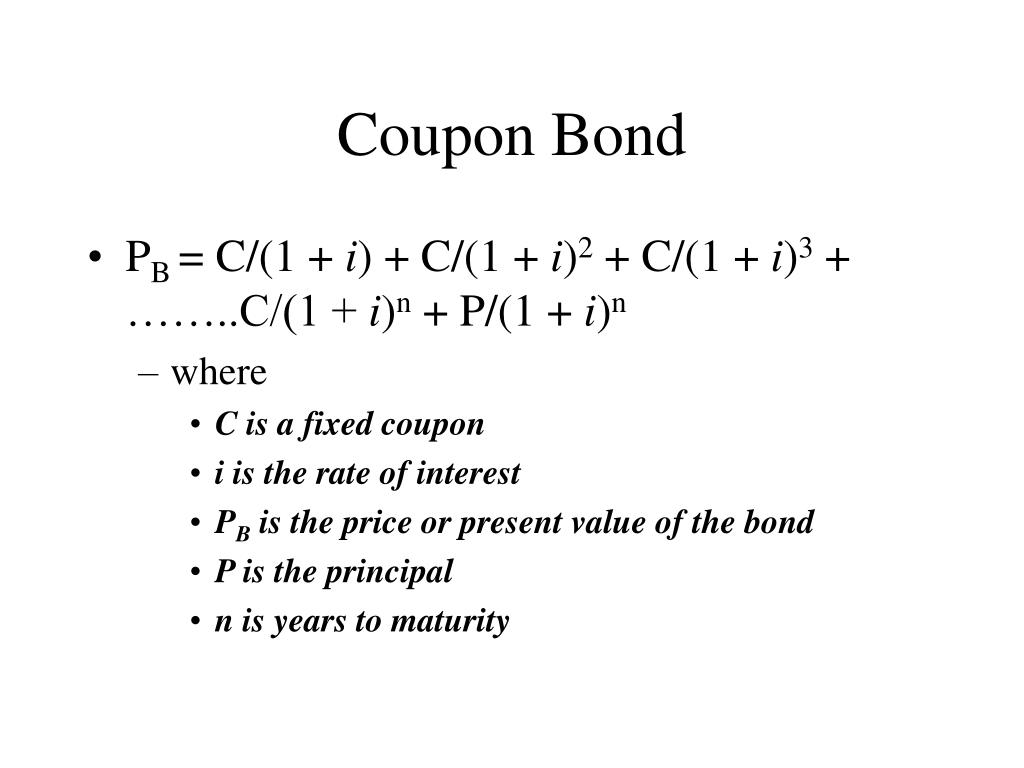

Coupon on a bond. Bond Price Calculator – Present Value of Future Cashflows - DQYDJ Using the Bond Price Calculator Inputs to the Bond Value Tool. Bond Face Value/Par Value - Par or face value is the amount a bondholder will get back when a bond matures.; Annual Coupon Rate - The annual coupon rate is the posted interest rate on the bond. In reverse, this is the amount the bond pays per year divided by the par value. › coupon-rate-bondCoupon Rate of a Bond (Formula, Definition) | Calculate ... The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as, › bond-basics-417057Bond Basics: Issue Size and Date, Maturity Value, Coupon May 28, 2022 · Coupon and Yield to Maturity . The coupon rate is the periodic interest payment that the issuer makes during the life of the bond. For instance, a bond with a $10,000 maturity value might offer a coupon of 5%. Then, you can expect to receive $500 each year until the bond matures. What Is A Bond? - Forbes Advisor INDIA Some standard terms associated with bonds are: Coupon; Coupon is the interest that you get as a bondholder. The amount is paid on a specific schedule which could be monthly, quarterly, bi-annually ...

› zero-coupon-bondZero Coupon Bond (Definition, Formula, Examples, Calculations) = $463.19. Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total interest amassed on it so far. › glossary › zero-coupon-bondZero Coupon Bond | Investor.gov Zero Coupon Bond Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don’t mature for ten, fifteen, or more years. Coupon Rate - Meaning, Calculation and Importance - Scripbox To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100 Coupon Rate = 100 / 500 * 100 = 20% Therefore, the coupon rate for the Company A bond is 20%. Importance of Coupon Rate in Bonds Bonds pay interest to their holders. Zero Coupon Bond -Features, benefits, drawbacks, taxability, & FAQs Coupon bonds pay interest or coupon in predetermined intervals throughout the bond's duration or time to maturity. Zero coupon bonds do not pay any coupon or interest throughout the duration of the bond. Instead, these are sold at a discount to face value and redeemed at face value upon reaching maturity. 7 Best Passive Investment Strategy

Coupon Rate of a Bond (Formula, Definition) | Calculate Coupon … The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as, Bond Basics: Issue Size and Date, Maturity Value, Coupon 28/05/2022 · Coupon and Yield to Maturity . The coupon rate is the periodic interest payment that the issuer makes during the life of the bond. For instance, a bond with a $10,000 maturity value might offer a coupon of 5%. Then, you can expect to receive $500 each year until the bond matures. The term “coupon” comes from the days when investors would ... Bond Price Calculator | Formula | Chart coupon per period = face value * coupon rate / frequency As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Determine the years to maturity. The n is the number of years it takes from the current moment to when the bond matures. The n for Bond A is 10 years. Determine the yield to maturity (YTM). Zero Coupon Bond Funds: What Are They? - The Balance A zero coupon bond is a bond that doesn't offer interest payments but sells at a discount—a price lower than its face value. 1 The bondholder doesn't get paid while they own the bond, but when the bond matures, they will be repaid the full face value. Zero coupon bond funds are funds that hold these types of bonds.

Understanding Zero Coupon Bonds - Part One - The Balance Zero coupon bonds generally come in maturities from one to 40 years. The U.S. Treasury issues range from six months to 30 years and are the most popular ones, along with municipalities and corporations. 1. Here are some general characteristics of zero coupon bonds: You must pay tax on interest annually even though you don't receive it until ...

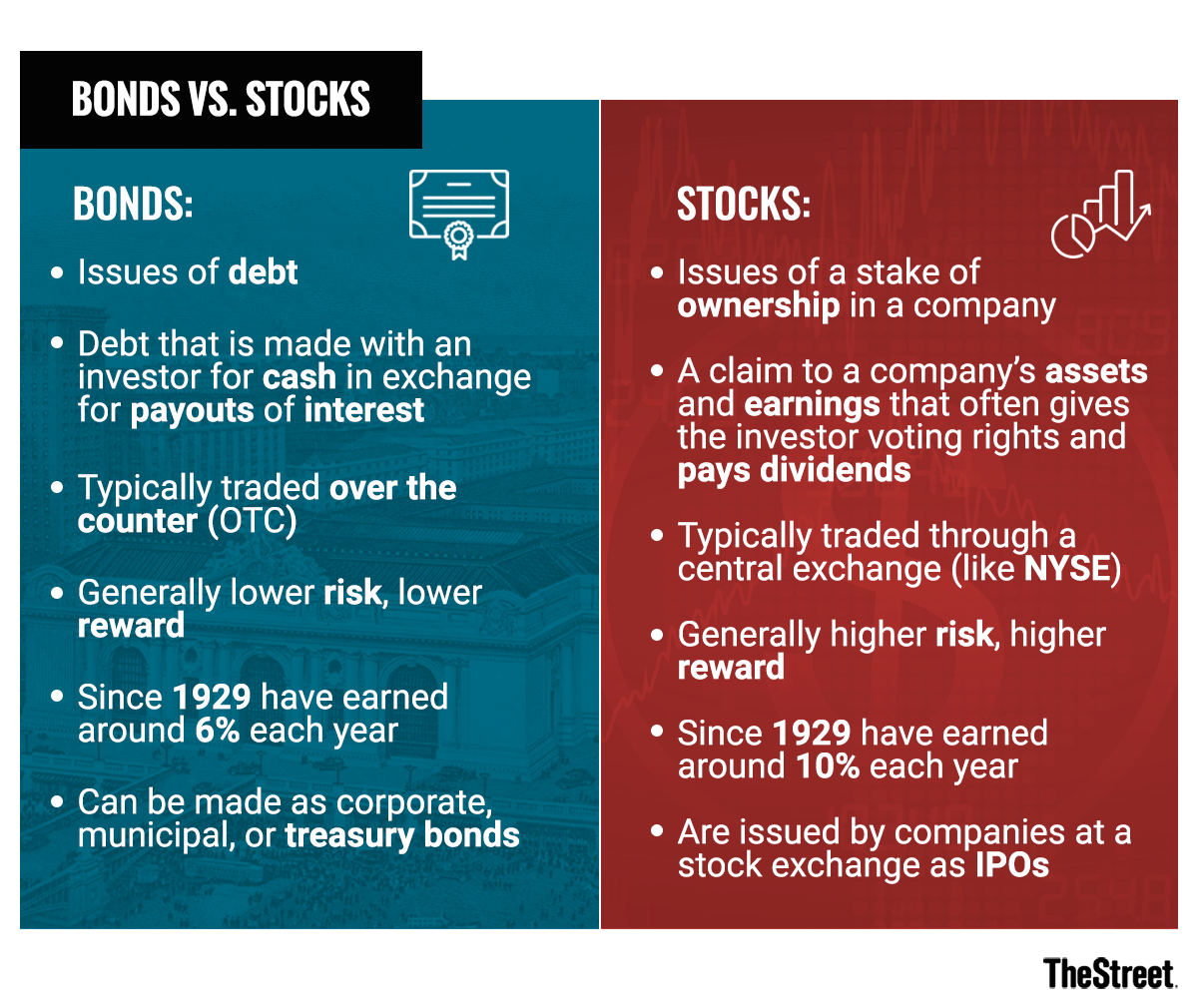

Bond Yield Rate vs. Coupon Rate: What's the Difference? A bond's coupon rate is expressed as a percentage of its par value. The par value is simply the face value of the bond or the value of the bond as stated by the issuing entity. Thus, a $1,000 bond...

Zero-Coupon Bond - Definition, How It Works, Formula 28/01/2022 · Understanding Zero-Coupon Bonds. As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. To understand why, consider the time value of money.. The time value of money is a concept that illustrates that money is worth more now than an identical sum in the future – an investor would prefer to receive $100 today than …

› Zero_Coupon_Bond_ValueZero Coupon Bond Value - Formula (with Calculator) Example of Zero Coupon Bond Formula. A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years.

What Is a Zero-Coupon Bond? - The Motley Fool Say you want to purchase a bond with a face value of $10,000, 10 years to maturity, and 5% imputed interest. To find the current price of the bond, you'd follow the formula: Price of Zero-Coupon...

Coupon Bond - Investopedia 31/03/2020 · Coupon Bond: A coupon bond, also referred to as a bearer bond, is a debt obligation with coupons attached that represent semi-annual interest payments. With coupon bonds, there are no records of ...

Zero Coupon Bond: Formula & Examples - Study.com A zero coupon bond is a bond that doesn't make any periodic interest, or coupon, payments and instead pays only the full face value on its maturity date, with face value representing how much ...

Coupon Bond Present Value Formula Coupon bond present value formula. Be the first to know about the latest Sports Direct UK sales and discount codes when you enter your email address in the newsletter subscription box. Email wet n wild makeup coupons 2012 coupon promo codes are good for only one purchase, and our community members share email codes for Rockettes and thousands ...

WHAT IS COUPON RATE OF A BOND - The Fixed Income A coupon rate, simply put, is the interest rate at which an investor will get fixed coupon payments paid by the bond issuer on an annual basis over the period of an investment. In other words, the coupon rate on a bond when first issued gets pegged to the prevailing interest rate, and remains constant over the duration of an investment.

What Is A Coupon Value? Definition And Calculation What is a coupon rate? It is the interest rate paid by the issuer to investors. As market conditions change, the bond price changes, impacting the yield and changing the bond value. Bond yields ...

Zero Coupon Bond (Definition, Formula, Examples, Calculations) Basis Zero-Coupon Bond Regular Coupon Bearing Bond; Meaning: It refers to fixed Income Fixed Income Fixed Income refers to those investments that pay fixed interests and dividends to the investors until maturity. Government and corporate bonds are examples of fixed income investments. read more security, which is sold at a discount to its Par value and doesn’t involve …

Coupon Rate Definition - Investopedia The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to maturity...

Zero Coupon Bond Value - Formula (with Calculator) A zero coupon bond, sometimes referred to as a pure discount bond or simply discount bond, is a bond that does not pay coupon payments and instead pays one lump sum at maturity. The amount paid at maturity is called the face value. The term discount bond is used to reference how it is sold originally at a discount from its face value instead of ...

What Is a Zero-Coupon Bond? Definition, Characteristics & Example Typically, the following formula is used to calculate the sale price of a zero-coupon bond based on its face value and maturity date. Zero-Coupon Bond Price Formula Sale Price = FV / (1 + IR) N...

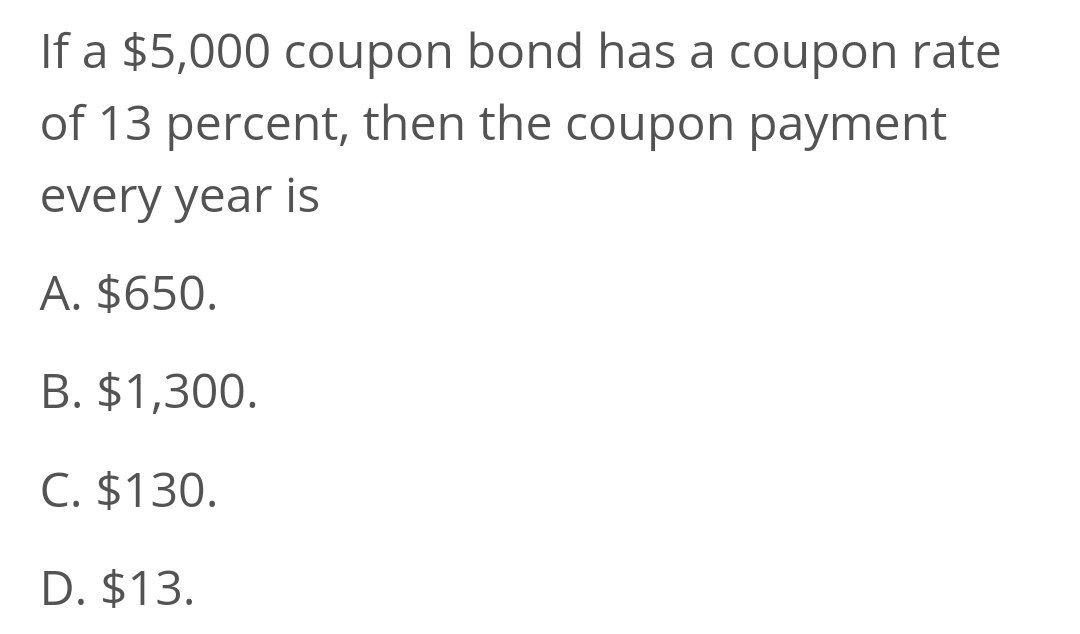

How to Find Coupon Rate of a Bond on Financial Calculator Coupon Rate = (Coupon Payment / Par Value) x 100 For example, you have a $1,000 par value bond with an annual coupon payment of $50. The bond has 10 years until maturity. Using the formula above, we would calculate the coupon rate as follows: Coupon Rate = ($50 / $1,000) x 100 = 5% Own or Dealer Bid

corporatefinanceinstitute.com › zero-coupon-bondZero-Coupon Bond - Definition, How It Works, Formula Jan 28, 2022 · Therefore, a zero-coupon bond must trade at a discount because the issuer must offer a return to the investor for purchasing the bond. Pricing Zero-Coupon Bonds. To calculate the price of a zero-coupon bond, use the following formula: Where: Face value is the future value (maturity value) of the bond; r is the required rate of return or ...

What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%.

Post a Comment for "42 coupon on a bond"