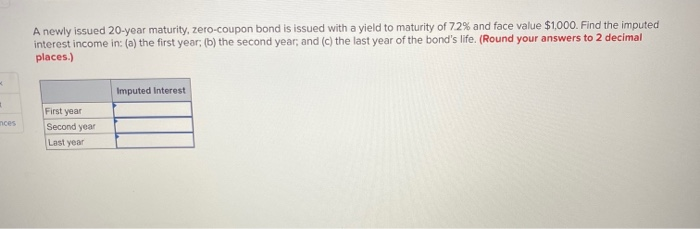

40 are zero coupon bonds taxable

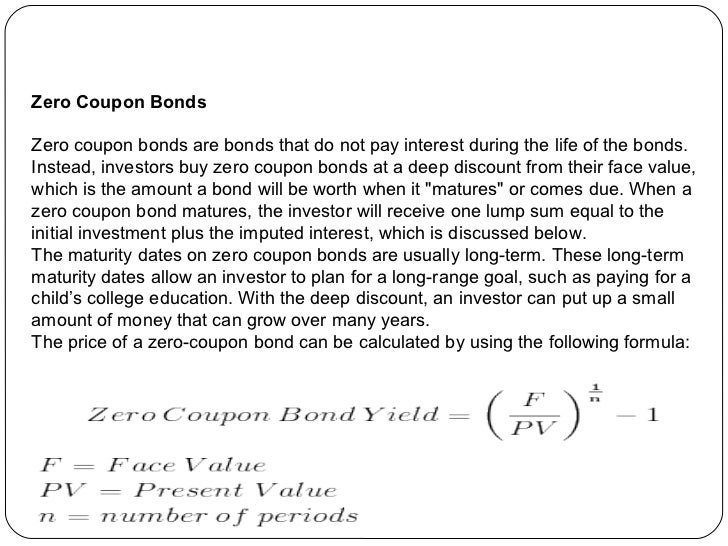

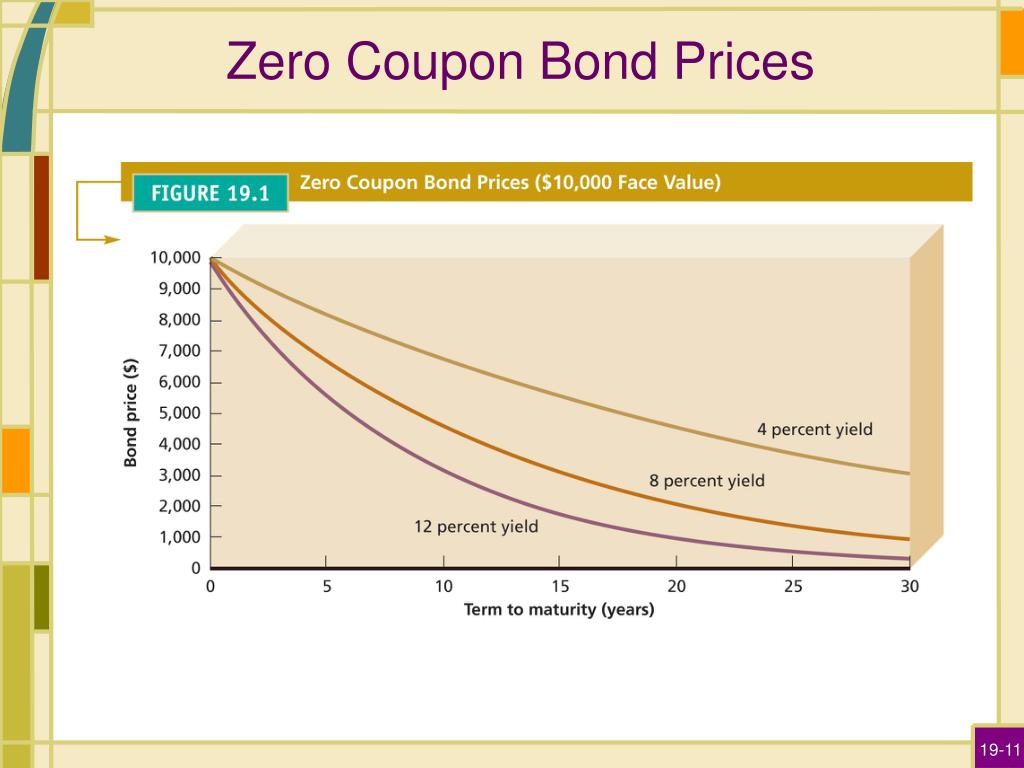

The ABCs of Zero Coupon Bonds - Tax & Wealth Management Zero coupon bonds are subject to an unusual taxation in which the receipt of interest is imputed each year, requiring holders to pay income taxes on what is ... Section 2(48) Income Tax: Zero Coupon Bonds - CA Club 1 Jan 2020 — If zero coupon bonds is held as capital asset, income from transfer thereof shall be taxed under the head 'income from capital gains' ...

Zero Coupon Bonds- Taxability Under Income Tax Act, 1961 Unlike other bonds or debentures, investment in zero coupon bonds does not give any periodic return. · Under Income Tax Act, gains on sale of any securities ...

Are zero coupon bonds taxable

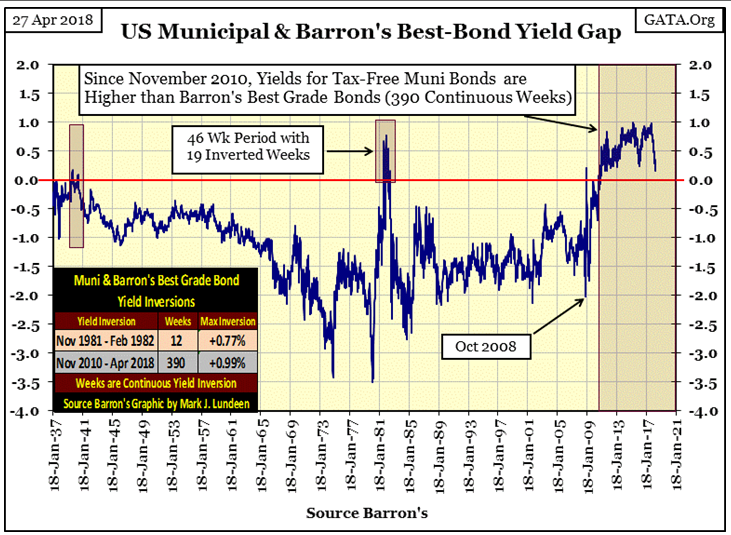

Impact of Taxation on Zero-Coupon Muni Returns 6 Apr 2017 — Tax risk: Although there are no interest payments made on zero-coupon bonds, investors may still be subject to the tax implications for the ... How Are Zero Coupon Bonds Taxed Uk? - ICTSD Zero-coupon bonds are usually discount bonds, with only one coupon on them that doesn't pay interest. It is common in the UK for some ... Advantages and Risks of Zero-Coupon US Treasury Bonds Similarly, tax-free zero-coupon bonds make excellent gifts for children who generate enough annual income to be subject to taxation on earnings. The bonds will ...

Are zero coupon bonds taxable. Zero Coupon Bond | Investor.gov Some investors avoid paying tax on the imputed interest by buying municipal zero coupon bonds (if they live in the state where the bond was issued) or ... What are Zero Coupon Bonds? Who Should Invest in Them? 13 Jan 2022 — As mentioned above, investors of notified zero coupon bonds issued by NABARD and REC are liable to pay only capital gains tax on maturity. Zero-Coupon Bond - Investment FAQ Taxes: Even though the bond holder does not receive any interest while holding zeroes, in the US the IRS requires that you “impute” an annual interest income ... Advantages and Risks of Zero-Coupon US Treasury Bonds Similarly, tax-free zero-coupon bonds make excellent gifts for children who generate enough annual income to be subject to taxation on earnings. The bonds will ...

How Are Zero Coupon Bonds Taxed Uk? - ICTSD Zero-coupon bonds are usually discount bonds, with only one coupon on them that doesn't pay interest. It is common in the UK for some ... Impact of Taxation on Zero-Coupon Muni Returns 6 Apr 2017 — Tax risk: Although there are no interest payments made on zero-coupon bonds, investors may still be subject to the tax implications for the ...

Estimated zero-coupon government bond yields At various maturities,... | Download Scientific Diagram

Post a Comment for "40 are zero coupon bonds taxable"